Let’s get into what is options trading. Understanding options trading is key. Stock options and buying options can open up a new world for us as investors. By looking into the history, we can see how this financial tool has evolved and shaped the market. Knowing the details of options trading will give us the info we need. It will help us make smart choices and navigate the markets. Join me as we dig into the world of options trading and find out the strategies that can help us make more money.

Quick points

- You need to know the basics of options trading to make informed decisions.

- Diversify your portfolio and gain benefits. These include option trading, leverage, and risk management.

- Compare options to stocks and futures. See which suits your goals.

- Try different options trading strategies. For example, covered calls or straddles. They help you make more money while managing risks.

- Know the players in the options market. They are: investors, speculators, and market makers. Knowing them will help you navigate the trading world.

- Learn the terms for options trading. They are: calls, puts, and strike price. You need them to talk about and do trades.

- Analyze the growth scenarios. Find the break-even points and maximum loss. This will show the risk-reward of different options strategies.

What is options trading?

Basics

Options trading gives us the right to buy or sell an asset at a fixed price within a certain time frame. We can benefit from market movements without owning the underlying asset. We can use options trading strategies to make money. They also protect us from market volatility. Call options allow us to buy an asset at a fixed price, put options allow us to sell an asset.

Types of options a call option and a put option

We have two types of options in trading: Call and Put options. Call options give the option buyer the opportunity to buy an asset at a fixed price, allowing them to profit when prices go up. Put options give us the right to sell an asset at a fixed price. They protect us from losing money in falling markets. For example, traders buy Call options in bull markets and Put options in bear markets.

Key points

We can compare options trading to other financial instruments: stocks, futures, and bonds. Doing this shows us the differences. Stocks are ownership in a company. Futures contracts obligate buyers/sellers to transact an asset. But, options give us flexibility without obligation. Options trading gives us leverage. We can control bigger positions with less capital. It also offers more gain potential. Risk management through hedging is more efficient with options contracts than traditional investments. You can enhance your understanding of options by exploring option trading strategies online by Manish Taneja.

How options trading works

Buying and selling

When we trade options, we buy and sell contracts at a fixed price within a certain time frame. Traders can enter into call option contracts without having to execute them. As buyers, we have the right to decide whether to buy or sell the underlying asset at a fixed price or option, depending on the underlying asset’s price. As sellers, we’re obligated to fulfill the contract if the buyer exercises the option.

Writing or selling options can carry theoretically unlimited risk, whereas buying options limits risk to the premium paid. However, writing or selling options can introduce greater risk than simply purchasing the underlying asset, so it is crucial to understand these risks and develop appropriate strategies.

Exercising options

Exercising options means we act on our rights as traders before the expiration date. As options traders, we have the right but not the obligation to exercise our contracts. The choice to use an option depends on many factors. These include market conditions, asset prices, and personal investment goals. By exercising an option, we can buy or sell the underlying asset at the agreed price.

Settlement

After buying or selling options contracts, we go through a settlement process. It closes the trade. Trades on options settle in two ways. Traders deliver the asset or settle in cash. Physical delivery transfers ownership of the actual asset.

Cash settlement exchanges cash based on the contract value. Clearinghouses play a big role. They oversee and help settle options trades. They make sure all parties meet their obligations. An at-the-money (ATM) option results in zero cash flow if exercised immediately, where the current index value equals the strike price, leading to no profit or loss.

Benefits of options trading

Flexibility in strategies

We can use many options trading strategies to achieve our financial goals. From long call to short call and straddles, each strategy has its purpose. A long straddle strategy involves buying both a call option and a put option for the same underlying asset at the same strike price and expiration date. Choosing the right strategy is key to success in the market.

Options traders can adjust their approach based on market conditions using these strategies. For example, a long call is good in a bull market, a straddle is good in a volatile market. A long call option gives traders the right to buy an underlying asset at a predetermined price before the expiration date. Knowing these nuances increases our chances of successful options trading.

Leverage

When we trade options, we leverage our investments to get bigger gains or losses. Leverage means we can control a bigger position with smaller capital. Long calls provide leverage by allowing traders to control larger positions with less capital. This amplification effect applies to both gains and losses in options trading.

Knowing leverage is important, as it affects our trading results. Leverage can give us big gains, but also exposes us to bigger risks. The maximum loss for a long call or long put is limited to the premium paid for the options. We balance risk and reward to minimize option trading losses. Understanding leverage also helps improve our stock trading strategy. Whether it’s options or stock trading, managing risks is key to success.

Risk management

Options trading has tools for risk management. Through hedging, we can protect our portfolio from market movements. Hedging means offsetting potential losses by taking an opposite position in another security.

Diversifying risk is another important aspect of options trading. We spread risk and boost performance by adding diverse options to our portfolio. Diversifying risk is another important aspect of options trading. We spread risk and boost performance by adding diverse options to our portfolio. A good example is the Iron Condor strategy, which helps manage risk by creating a balance between potential profits and losses in a low-volatility market. Options is a big player in risk management and stability of our investments.

Options versus others

Stocks vs. options

Individual stocks are ownership of a company. Options are the right to sell or buy an asset. Options requires lower capital and has leverage compared to direct stock investment. But it also has higher risks because of its limited life and potential loss of the entire investment. Stocks has long term growth and dividends, but no leverage like options.

Futures vs. options

When we compare futures to options, we see that futures contracts make parties sell or buy an asset. They do so at a set price and date. Options give us the choice, but not the duty, to do so. Futures contracts involve the delivery of assets when they expire. This adds complexity and risk. Options trading enables a risk management strategy. It gives us the flexibility to choose whether to use the contract. To better understand this flexibility, the Option Chain Course provides valuable insights. It helps us analyze and interpret option chain data effectively, enhancing our ability to make informed decisions in trading.

Bonds vs. options

Bonds and options differ. Bonds are debt securities. Governments or corporations issue them. They have fixed interest payments until maturity. The value of options comes from underlying assets and the right to transact at a specified price. Investors can use them for speculation or hedging. Bonds give us a steady income and stability. Options trading gives us bigger returns. It does so through strategic trading based on market movements.

Trading strategies

Hedging

Hedging in options trading is a risk management technique. We use it to protect against potential losses by considering the underlying asset’s price. We use options contracts to offset risks from the price movement of the underlying asset. This is important to safeguard our investment portfolio from unexpected market movements.

Options give us flexibility. We manage risk by balancing our investment strategy. Hedging allows us to stay in the market while minimizing losses. Good hedging means we can navigate volatile markets with more confidence.

Speculation

When we speculate in options trading, we aim to grow from market movement. By predicting significant price movement, we can make money through options trading. But we must acknowledge the risks involved in speculation.

Speculation requires us to understand markets well. We must also be able to analyze trends. One can make big gains, but there are also big risks. We conduct thorough risk assessments to form well-informed trading decisions.

Income generation

Options trading has strategies for us to generate income as part of our investment. We can use options for regular income. Strategies like covered calls and cash-secured puts let us do this.

The costs associated with options trading can include premium payments and commission fees, which impact profitability. However, options trading offers cost effectiveness, as we sell options contracts to earn premiums over time.

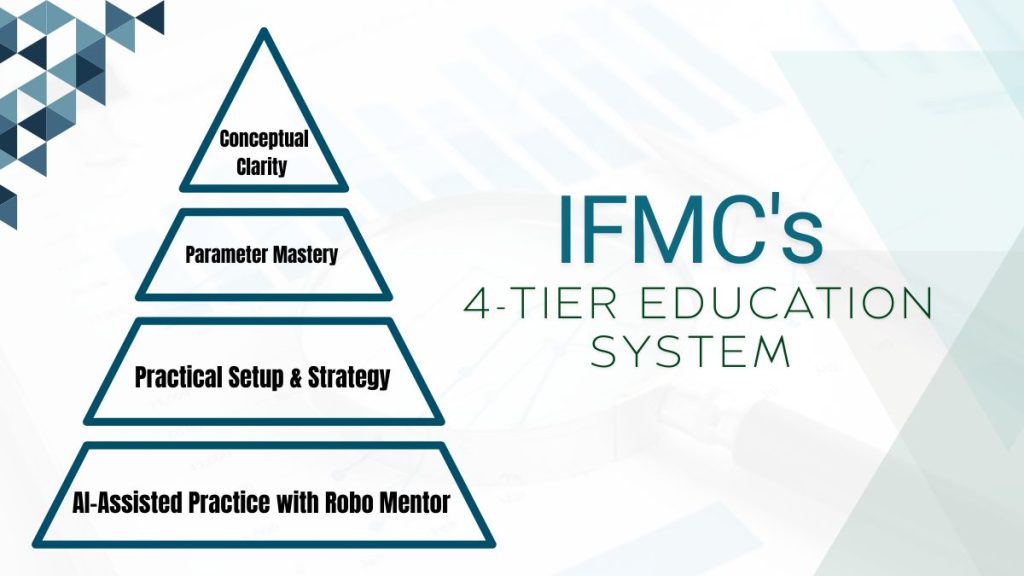

Generating income through options trading requires discipline and good risk management. Using a specific strategy for income generation, where the potential losses are limited to the premium paid, can boost our returns. It can also help us manage risk It can also help us manage risk, especially if price falls occur in the market. We must prioritize risk management. This is where the option strategy course with UDTS Strategy becomes very useful. It provides a structured approach to implementing income-generating strategies while keeping risks in check.

By learning and applying the strategies taught in the UDTS Strategy course, we can maximize our earning potential and make options trading a consistent source of income.

Market participants

Retail Traders

Retail traders are the lifeblood of the derivatives market. They buy and sell options. We, as individual investors, can trade options online. Various platforms give us market access. This access allows us to try out different trading strategies. We might grow from market moves.

Options trading involves buying and selling financial contracts known as options, highlighting the rights associated with call and put options. We can manage our risk exposure and leverage our capital through options contracts.

Options trading is more complex than trading stocks and requires a good understanding of market dynamics and indicators. But understanding complex options strategies and managing losses requires continuous learning and discipline. Despite the challenges, active participation in the market of options can reward retail traders. They need caution and patience.

Institutional investors

Hedge funds and investment banks are institutional investors. They are big players in the derivatives trading. They’re big because of their size and complex trading strategies. They use options not only for speculation but also for hedging against market risks. Their activity can move the market a lot. It affects prices and market sentiment.

Institutional investors’ actions have a big impact. They affect the liquidity and efficiency of the derivativesmarket. By doing large volume trades, they add to market depth and stability. But their trades can also cause volatility. Unlike retail traders, institutional investors often do not need to pay the entire transaction value upfront, allowing them to leverage their positions significantly. They affect pricing and can magnify moves.

Market makers

Market makers provide the oil. They keep the options market moving by offering continuous liquidity. They are intermediaries between buyers and sellers. They ensure there is always a market for options contracts. Quoting bid-ask prices helps. It makes trades smooth and prices fair in the options market.

Being a market maker is all about balancing incentives with risks. They earn from the bid-ask spread. But, they also face losses from price drops or sudden market changes. Keeping low prices and considering the current underlying asset’s price is key to their operation. So is managing risk to keep cash.

Options trading terms

The strike price

In options trading, investors can buy or sell the underlying asset at the option’s strike price. Someone exercises an option. This is important because it affects the desirability of the trade. When picking a strike price, we’re setting the future deal price. The choice of strike price is key to our potential gains or losses in options trading strategies.

Premium

In options trading, the premium is the price paid for an options contract. It’s the total cost of buying the right to buy or sell the underlying asset at a specified strike price. Market volatility and time to expiration are big factors that affect the premium. Understanding and analyzing these factors help us determine the risk and potential returns.

Expiry date

The expiry date of an options contract is the deadline by which we must decide whether to use our rights in the contract. It is the timeframe within which we can act on our option position. Knowing the same expiration date for multiple options is important, especially for strategies like the Long Straddle and Long Strangle.

It affects our decisions and trading strategy. Knowing this expiration date lets us make timely and informed decisions. We can use it for trading options. Options contracts come with a fixed expiry date, usually the last Thursday of a calendar month.

Gain scenarios

In the money

When an option is “in the money,” it has value from its terms. This is when the option’s strike price is more favorable than the current market price. This often means gains for options traders. For example, A call option’s value rises when its strike price drops below stock value.

Options that are in the money have real benefit potential and can lead to maximum profit. This is because they already have intrinsic value. It’s due to their favorable position relative to the market price. Traders can take advantage of this by exercising the option or selling it at a premium. Being in the money means immediate gain for traders.

At the money

”At the money,” options have a strike price. The price is equal to the current market underlying asset’s price. In this case, there is no intrinsic value in the option. Options at the money are important. They offer flexibility in option trading. You can use them for hedging or speculation. At-the-money options are key in trading strategies. They result in zero cash flow if exercised immediately, as the current index value equals the strike price, leading to no profit or loss.

The option’s price in such cases is purely based on volatility and time remaining until expiration, making them attractive for short-term strategies. Traders can use these options to adjust their positions. They do this based on market conditions and volatility. At-the-money options are flexible. Traders can use them to adapt to changing markets.

Out of the money

When an option is “out of the money,” it has no intrinsic value. This is when the option’s strike price is not good compared to the current market price of the underlying asset, including scenarios of falling prices. Options that are out of the money don’t have much going for them except time. They are riskier, but can pay off if conditions change.

Being out of the money means that options traders have no immediate gain. They can’t benefit from exercising or selling their contracts. But, these options can still have speculative value. They rely on future market movements for gains. Traders may choose out of the money options for their lower upfront cost and higher leverage.

Conclusion

We’ve covered option trading and now we have a better understanding of this market. We have seen the flexibility and potential of options. We’ve seen this from the basics to complex strategies. We can trade with confidence because we have the tools. We have them from comparing to other instruments and desirability scenarios.

Let’s continue to learn and grow in options trading. It is key for both new and experienced investors to stay informed and involved in the stock market. Keep learning new strategies, analyzing market trends and learning from each experience. Together we can use options trading to supercharge our financial journey. Let’s do this!

FAQs

What is options trading?

In options trading, you can make money by predicting the direction of an underlying asset’s price movement. You can buy a call option if you think the price will rise, considering the call strike price to evaluate potential profitability. Or, buy a put option if you think it will fall.

How the option does it work?

Option trading offers higher returns. It has lower upfront cost than traditional stock trading. It also offers flexibility and risk management tools. You can benefit in up and down markets, with call options being particularly advantageous during rising prices..

What are the benefits?

Option trading offers higher returns. It has lower upfront cost than traditional stock trading. It also offers flexibility and risk management tools. You can benefit in up and down markets.

How do options compare with other instruments?

Options offer few risks, leverage, and flexibility. They have less of these things than stocks or futures. They hedge against market volatility. You can trade in many conditions.

Who participates in options trading?

Individual investors, institutional traders, market makers, and speculators participate in options trading. Each plays a different role in the market. They add liquidity and find prices while trading to meet their goals and risk appetite.