Imagine this: out of 3,000 stocks only 50 are super performers. These 50 aren’t any ordinary stocks; they are the Nifty 50. But what makes them nifty? These stocks were the best in the 1960s and 1970s. They were the strongest and most stable US companies. Today the concept of Nifty 50 still intrigues investors worldwide. In this post, you’ll learn “What is Nifty 50? in the Nifty Stock Market” and the history of these elite stocks. They shaped investment strategies. Do they still matter in today’s fast world? Let’s get into the world of Nifty 50 and get some insights for your investment journey.

Quick Facts Nifty Stock Market

- NIFTY 50 helps you to know the top 50 companies.

- Invest wisely, consider NIFTY 50 stocks for growth.

- Knowing the criteria for listing on the NIFTY 50 helps you evaluate stocks.

- NIFTY 50 affects the stock market and investor decisions.

- Follow the top NIFTY 50 companies to know the market.

- Stay updated on NIFTY 50 milestones to know the market’s health.

NIFTY 50 Explained

What is Nifty 50?

NIFTY 50 is a stock market index. The NIFTY 50 index was set with a base value of 1000 and a corresponding base market capital on 3rd November 1995. It shows the performance of the top 50 large-cap companies. They are listed on the National Stock Exchange (NSE) of India. It is a benchmark index in the Indian stock market.

Why does Nifty 50 matter in the Indian stock market?

NIFTY 50 is a benchmark index that represents the overall market. They use it to track the overall market performance and make smart choices.

Indices

What is an index

A stock index is a statistical measure of a particular segment of the stock market. It is a basket of stocks that represents a particular sector, industry, or market.

Stock Indices 101

Stock indices are tools that represent a part of the stock market, to track a group of stocks. They give you a snapshot of how many companies, a particular segment of the broader market, are performing. There are different types of stock market index or indices. They can be price-weighted, market-cap-weighted, or equal-weighted.

- Price weighted: Calculated based on the price of individual stocks in the index.

- Market capitalization weighted method: Stock weights are set by the total market value of their outstanding shares, considering only the shares available for trading in the open market, excluding shares held by promoters, governments, or strategic investors.

- Each stock in the index receives equal importance. This is true regardless of market value.

How do indices work in the stock market?

Indices provide a benchmark for investors to compare their investments. They help investors to track the overall market trends and make informed investment decisions.

NIFTY 50 Overview

NIFTY 50 is a benchmark index made by the National Stock Exchange. It includes the top 50 Indian stocks. It’s a leading indicator of blue chip companies in India’s stock market indices. The NIFTY 50 covers banking, information technology, and consumer goods. They are the backbone of the Indian economy.

- NIFTY 50 is for big companies in India.

- It gives you the pulse of blue chip companies across sectors.

- NIFTY 50 is for investors to know the market and economy.

Significance in the Market

NIFTY 50 is a big index in the Indian stock market and has a big impact on investor sentiment and market trends. As a benchmark index, it gives you valuable insights into the Indian economy. Follow NIFTY 50 to make informed decisions on your portfolio.

- NIFTY 50 sets the trend for all sectors.

- Investors track NIFTY 50 to know the market and adjust their strategy.

- NIFTY 50 is the barometer for the economy and business in India.

How is Nifty 50 calculated?

Free float market capitalization method

The NIFTY 50 index is calculated using the free float market capitalization method. This method considers the base market capital of only the shares available for public trading, excluding shares held by promoters, government, employees, and other strategic partners. These shares are available for trading.

Calculation and Frequency

NIFTY 50 calculates and updates every second during market hours. The NIFTY 50 index is calculated based on the free-float market capitalization of the top 50 companies. Each stock’s free float market capitalization determines its weight.

Index Calculation

NIFTY 50 indices use float-adjusted, market-cap-weighted methods. We calculate the index value based on the number of shares available for trading. And we use the total market value of those shares. The formula calculates the index value. It uses the current stock prices and the base value of the market cap.

Here is the **nifty calculation formula** for the index value: Index Value equals Current Market Value divided by (Base Market Capital times 100). Current Market Value is the combined market capitalization of all 50 companies in the index.

Corporate actions like rights issues and stock splits can impact index calculation. For example, if a company issues new shares through a rights issue, it can change the stock’s market cap. This change affects its weight in the index. Stock splits boost shares outstanding, adding to the index value.

Eligibility

To be a part of NIFTY Index, companies must meet certain eligibility criteria. These criteria include domicile and liquidity-related criteria. Also, companies with Differential Voting Rights (DVR) shares meet these criteria. They can also be in the NIFTY Index.

The NIFTY Index is often reconstituted. This is to ensure that the listed companies meet the eligibility criteria. Stock performance and listing norms form the basis for this reconstitution. The index may drop companies that don’t meet the standards. It can also include new companies that do meet the standards.

Types of Indices

When it comes to stock indices, there are price-weighted ones. There is also market capitalization-weighted and equal-weighted ones. Each has its own features and benefits. Indices weighted by price give more weight to higher-priced stocks. Market-cap-weighted indices consider the total value of the company.

Market capitalization determines the weighting of indices like NIFTY 50. They harness information technology behind them to provide precise market value representations. Equal-weighted indices give equal weight to each stock. They provide a more balanced view of the stock brokers’ current market value.

NIFTY 50 Listing Criteria

Eligibility

To be a part of the NIFTY 50 index, companies must meet certain eligibility criteria. The eligibility criteria for NIFTY index listing include conditions related to domicile, liquidity, impact cost, market capitalization, trading frequency, and voting rights. These include high liquidity, substantial market capitalization, and frequent trading. Companies meeting these criteria are more stable and reliable.

Meeting the eligibility criteria is important. Companies must meet them to be part of the NIFTY Index. They boast strong finances, conduct regular transactions, and wield considerable market power. By meeting these criteria companies get more visibility and attract more investors.

These eligibility criteria govern the NIFTY Index. These companies meet the criteria. They add to the stability and integrity of the index. This way, it reflects the Indian stock market well.

Nifty 50 listing requirements

Companies must be listed on the National Stock Exchange (NSE) of India. The NIFTY share index comprises actively traded companies across various sectors and provides diversification, liquidity, and transparency. They must have minimum market capitalization and liquidity. They must have minimum trading frequency and impact cost.

Selection process and review frequency

The process of selecting the top 50 equity stocks for the NIFTY 50 index is rigorous and transparent. The criteria used is to by market capitalization identify the most liquid and largest Indian stocks. Stocks with a market capitalization and abundant trading volumes enable swift purchases or sales in the securities market at steady prices.

Transparency and objectivity are the core of the NIFTY 50 selection process. Investors can understand how the index picks stocks. It does this by publishing explicit criteria for all to see. This transparency builds confidence among the market participants.

- The company bases the process on its market capitalization, liquidity, and trading frequency.

- Every six months, the NIFTY 50 index undergoes a review and rebalance. This keeps it accurate as a representation of the Indian stock market.

- Prospective companies with high liquidity

- More visibility

- Investor confidence

Inside the Index

Formula

When you calculate NIFTY 50 you use a formula that combines market risk, derivatives, base capital, and float. A float-adjusted and market capitalization-weighted method calculates the index value. First, we take current market values along with the above base value and market capitalization. So the index is correct.

Corporate actions play a big role in NIFTY 50. The calculation factors in stock splits or dividends. By including these adjustments the index is up to date.

Key Points:

- Float adjusted and market capitalization weighted.

- Corporate actions for accurate calculation.

Review

Administrators conduct regular reviews of the NIFTY Index to update it. Reviews happen often. They involve checking stock performance and eligibility criteria. The frequency of reviews ensures the index is correct.

In the review, stock performance is key. It is market performance that decides if a stock is in the NIFTY 50 index. During reconstitution, we may replace stocks that do not meet the criteria. So the index has the best stocks.

Key Points:

- Reviews keep the NIFTY Index correct.

- Stock performance decides reconstitution.

Nifty 50 Constituents

Nifty 50 companies list

The NIFTY 50 index has the top 50 large-cap companies. National Stock Exchange (NSE) lists top companies, such as Reliance Industries, HDFC Bank, and Infosys.

Sector and weightage

The NIFTY 50 has sector representation and weightage. It is around 40% in finance, 20% in tech, and 10% in consumer goods.

National Stock Exchange (NSE) and India Index Services

About the National Stock Exchange NSE and its importance in the Indian stock market

The National Stock Exchange (NSE) is one of the largest stock exchanges in India. It provides a platform for trading in equities, derivatives, and other financial instruments.

India Index Services and its role in Nifty 50

India Index Services (IISL) is a subsidiary of the National Stock Exchange (NSE). It maintains and calculates NIFTY 50 and other indices. NSE Indices Limited, previously ***India Index Services*** & Products Limited, now NSE Indices.

Nifty 50 Companies

Winners

Top NIFTY 50 performers include Reliance Industries and HDFC Bank. These companies have shown good growth and stability in their stock. Analyze these top performers to see how they adapt to the market and give consistent returns.

Reliance Industries is one example. It has diversified into various sectors like telecommunications, retail, and petrochemicals. This diversification has helped the company to be one of the top stocks in NIFTY 50. HDFC Bank focuses on customer service and new banking solutions. This has led to the company’s success.

The factors that make these top performers successful may vary. But, they often include strong leadership, innovative strategy, and risk management. Investing in top performers can boost your growth and returns.

Sector-wise

Look at the sector-wise representation in the NIFTY 50 index and you will see a mix of industries in the index. Sectors such as finance, technology, consumer goods, and energy drive the index upward. Understand the sector mix. Then, you can make informed decisions when investing in NIFTY 50 stocks.

Stocks are divided by sector. This gives investors exposure to different industries. It lowers the risk of investing in one sector. For example, if one sector is down, your investments in other sectors can offset the losses. This diversification benefit is key. It is one of the advantages of investing in a well-balanced index like NIFTY 50.

Nifty 50 Milestones

Past Events

In 1996, National Stock Exchange (NSE) launched NIFTY 50, which included 50 of the most liquid and large-cap stocks. The introduction of NIFTY Bank index derivatives marked another significant milestone in the history of NSE. Over the years it has become the benchmark index of Indian equity markets. NIFTY Index tracks the top companies across sectors.

Nifty 50 Investing

Investing in NIFTY 50 gives you a diversified portfolio. It holds large-cap companies in many sectors. It gives you a benchmark return. The return reflects the overall performance of the Indian stock market.

How to invest in Nifty 50: direct stock route, index funds and more

Investors can invest in NIFTY 50 through stocks, index funds, ETFs index futures, and other products in securities markets. Investors can also consider index mutual funds that track the NIFTY 50 index for a cost-effective and convenient investment option.

Investing in the NIFTY 50 index gives you different options. Consider index funds. They mimic the NIFTY Index’s performance and give you a diversified portfolio. Another option is exchange-traded funds (ETFs). They give you flexibility and are easy to trade on the stock exchange.

You can also use derivatives linked to the NIFTY Index for investment purposes. You can use these financial instruments to bet on the index movement. You can do this without owning the underlying assets. Before you start, be sure you know the risks and rewards of each investment type.

Investor Benefits

Investing in the NIFTY 50 index has benefits for both individual and institutional investors. Adding NIFTY to your investment portfolio gives you diversification. It covers top Indian stocks and reduces specific risks. This diversification protects you from individual stock volatility.

NIFTY offers growth and stability. This aligns with the goals of long-term investors. It helps in risk management by spreading your investments across multiple sectors.

Nifty 50 vs Sensex

Nifty 50 and Sensex comparison

NIFTY 50 and Sensex are the two most followed benchmark indices in the Indian stock market. NIFTY 50 is a free float market-cap-weighted index. Sensex is a market-cap-weighted index.

Conclusion

Now you know everything about NIFTY 50, from how it works to who’s inside it. NIFTY 50 is your key to making informed investment decisions. Keep an eye on those milestones and criteria while you dip into the NIFTY 50 pool.

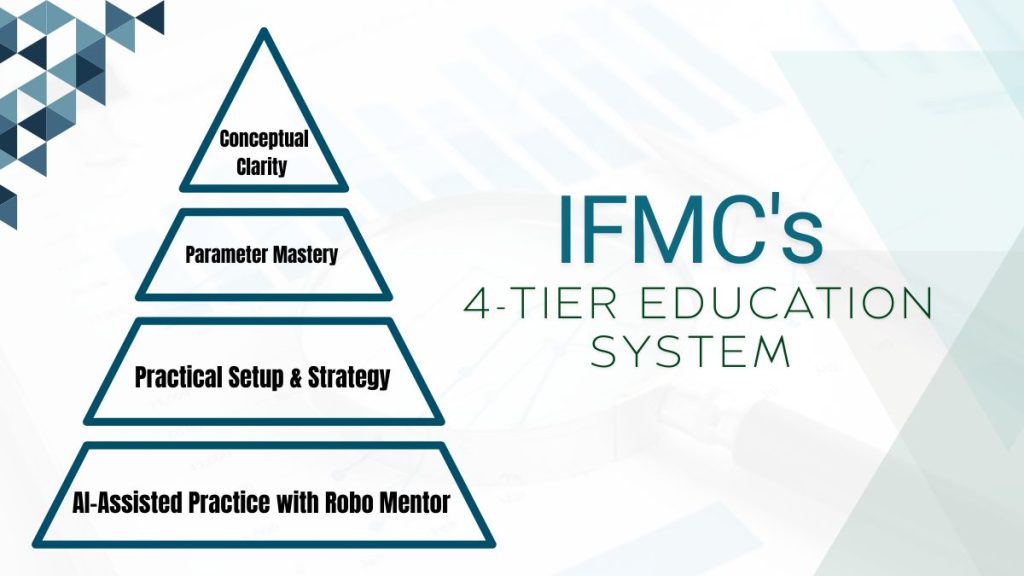

What are you waiting for? Dive in and explore NIFTY 50 with IFMC Institute. For classroom stock market courses and online stock market courses. Your next investment journey at IFMC, the Institute of Financial Market Courses in India!

Nifty 50 summary and importance in the Indian stock market

NIFTY 50 is a benchmark index in the Indian stock market. It gives you a benchmark return. The return reflects the overall performance of the Indian stock market. It is a diversified index with a mix of large-cap companies across sectors.

FAQs

What is NIFTY 50?

NIFTY 50 is the top 50 stocks listed on the National Stock Exchange (NSE) of India. The NIFTY stock market index is a benchmark for measuring the performance of mutual funds in the Indian financial market. It is a benchmark index used by investors to measure the market.

How does NIFTY 50 work?

NIFTY 50 works by calculating the weighted average of its 50 stocks. Market capitalization weighs it. Larger stocks have more impact on the index.

Who is eligible for NIFTY 50?

In the Nifty stock market, a company must meet certain criteria to be in the NIFTY 50 index. These include market value, liquidity, and trading frequency. Companies need to comply with these criteria to remain in the index.

Who are the constituents of NIFTY 50?

NIFTY 50’s constituents are famous Indian companies. The companies are Reliance Industries, Infosys, HDFC Bank, Tata Consultancy Services Ltd, and Hindustan Unilever. These are the pillars of the index.

How to invest in NIFTY 50?

You can invest in NIFTY 50 through index funds, ETFs index futures or structured products, or mutual funds that track the index. Invest in these to get exposure to top Indian stocks.