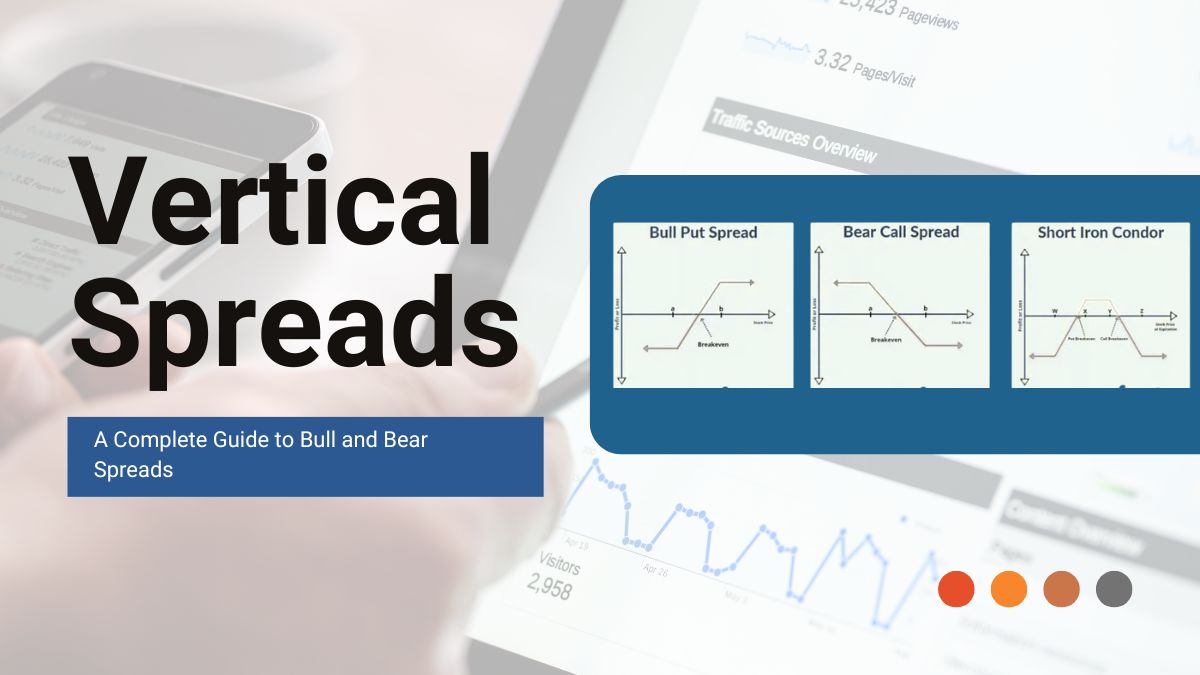

Did you know 65% of options traders use vertical spreads options as their number one strategy? No wonder they’re a mainstay of professional options trading. Verticals offer defined risk and gain potential that’s perfect for today’s crazy markets. Whether you’re bullish or bearish, learning verticals will add to your options trading toolbox.

In this guide we’ll cover everything you need to know about vertical spread options from the basics to advanced trading techniques. A vertical spread strategy involves buying and selling options of the same type (calls or puts), with the same expiration date but different options strike prices. This helps manage risk and limit losses while taking advantage of market movements.

What are Vertical Spreads?

A vertical spread is a trading strategy that involves buying and selling options on the same underlying asset, but different strike prices. It’s designed to make money from trends while limiting losses. Verticals can be bullish or bearish so they’re good for all market conditions.

In a vertical spread you buy and sell the same type of option (calls or puts) with the same expiration but different strike prices. This allows you to create a defined risk reward scenario. For example in a bull call spread you might buy a call with a lower strike and sell a call with a higher strike. In a bear call spread you’d sell a call with a lower strike and buy a call with a much higher strike price.

The main advantage of verticals is they limit your losses while still offering value opportunities. By choosing the right strike prices you can tailor your strategy to your market view and risk tolerance. Whether you think the the underlying asset will go up or down, verticals give you a structured way to play the market.

Vertical Spread Basics

At its core a vertical spread is buying and selling the same type of option (calls or puts) with the same expiration but different strike prices. This type of manage vertical spread can be further broken down into debit spreads and credit spreads depending on if you pay a net premium or receive one. The term “vertical” comes from the way options chains are displayed on a trading platform with different strike prices listed vertically.

To really understand verticals let’s break them down:

A vertical spread has two legs:

- The long leg: An option you buy

- The short leg: An option you sell

For example, if you’re creating a bull call spread in India, you might buy a call with a ₹2000 strike price and sell a call with a ₹2050 strike price, both expiring in 30 days. This creates a defined risk-reward scenario where your maximum loss is limited to the net debit and your maximum gain is the difference between strikes minus the net debit.

Time decay affects verticals differently than single-leg options positions. Since you’re long and short options, theta (time decay) not all vertical spreads can work for or against you, depending on the spread. This is why verticals are so attractive to Indian traders who want to minimize the impact of time decay.

Bull Spreads: Playing Up

Bull spreads are for traders who think the the underlying asset’s price will go up moderately. There are two types of bull spreads: bull call spreads and bull put spreads.

Bull Call Spreads

A bull call spread is buying a call at a lower strike and selling a call at a different strike, both with the same expiration date. A bull call spread involves buying an in-the-money call option and selling an out-of-the-money call option with the same expiration date. This requires an initial debit but has a defined risk reward.

Maximum gain occurs when the net premium received the underlying goes above the higher strike. Profit is: Maximum Profit = Distance between strikes (including the higher strike call option) – Net debit.

For example:

• Buy the ₹2000 call for ₹30

• Sell the ₹2050 call for ₹10

• Net debit = ₹20

• Maximum gain = (₹2050 – ₹2000) – ₹20 = ₹30

Bull Put Spreads

Bull put spreads are a type of vertical credit spread. You sell a put at a higher strike and buy a put at a lower strike. This is a credit spread so you receive net premium paid upfront. The strategy values when the underlying is above the higher strike.

The advantage of bull put spreads is immediate credit but they require margin and have assignment risk. Your maximum gain is the net credit and your maximum loss is the difference between strikes minus the net credit.

Bear Spread Strategies: Playing Down

Bear spreads are one of the two types of vertical spreads used to play down. Bear spreads, including the short vertical spread, allow you to profit from down markets with defined risk. Like their bull cousins, bear spreads come in two forms: bear call spreads and bear put spreads.

Bear Call Spreads

Bear call spreads are selling a call at a much lower strike price and buying a call at a higher strike. In a bear call spread, the strategy involves selling an in-the-money call and buying an out-of-the-money call. This is a credit spread that profits when the underlying is below the lower strike. Good for a small down or sideways.

Things to consider for bear call spreads:

- Early assignment risk on the short call

- Margin requirements

- Volatility impact

- Optimal strike selection based on technicals

Bear Put Spreads

Bear put spread is buying a put at a higher strike and selling a put at the same strike price but a lower strike. This is a debit spread that gains from down movement in the underlying. Maximum loss is the initial debit and maximum gains is the difference between strikes minus the debit.

Strike Selection

Strike selection is key when using a vertical spread. The strikes should be based on the trader’s market view and risk tolerance. For a bull vertical spread you buy a call at a lower strike and sell a call at a higher strike. This way you profit from up movement in the underlying and limit your loss to the net debit, especially when utilizing long vertical spreads.

For a bear vertical spread you sell a call at a lower strike and buy a call at a higher strike. This is a credit spread so you receive premium upfront. The strategy gains when the underlying is below the lower strike, with maximum loss being the difference between strikes minus the net premium paid in credit.

Choosing the strikes involves looking at the underlying’s price trend, volatility and technicals. Traders often use support and resistance, moving averages and other technicals to determine the strikes. And considering the implied volatility can help you choose the strikes that match the market conditions.

Advanced Vertical Spread Strategies

Once you have the basics down several advanced techniques can help you with vertical spreads:

Delta-Neutral Construction

Creating delta-neutral spreads allows you to trade volatility while minimizing directional risk. This means selecting strikes that result in a position delta near zero so the spread is sensitive to volatility changes rather than to the stock price’s movement.

Rolling

Rolling is closing an existing spread and opening a new one with different strikes or expiration dates. Common rolling scenarios:

- Rolling up: Higher strikes

- Rolling out: Further out in time

- Rolling up and out: Both

Volatility Skew Trading

Understanding and using implied volatility skew can help with spread selection and timing. Vertical spreads can be constructed to take advantage bullish vertical spread of the volatility skew between different strikes.

Risk Management and Position Sizing

Vertical spread trading requires good risk management. Here are the rules:

Position Sizing

- 1-3% of total portfolio per position

- Consider multiple spread positions together

- Include maximum loss in margin calculations

- Size position based on probability of gain

Early Assignment

Early assignment risk is more relevant for credit spreads. Manage this risk by:

- Monitoring dividend dates

- Understanding pin risk at expiration

- Having enough buying power for the assignment

- Closing before expiration when possible

Adjustment Strategies

When you get stopped out consider:

- Rolling the spread to different strikes

- Adding wings to iron condors or butterflies

- Scaling in or out

- Mechanical adjustment points based on delta or price

Vertical Spread Pros and Cons

Vertical spreads have advantages and disadvantages to consider before you use this strategy.

Conclusion

Vertical spreads are a powerful tool in the options trader’s toolbox, offering defined risk and big gain potential. To be successful with these strategies, you need to understand how they work, size your positions correctly and manage your risk consistently.

A vertical spread options strategy involves buying and selling the same type of option (calls or puts) with the same expiration but different strikes, it offers defined risk-reward and reduces time decay. This versatile strategy includes bull spreads (call and put) and bear spreads (call and put) each designed to gain from specific market moves while capped risk. Vertical spreads are attractive because they require less capital than buying options outright, have built-in volatility protection and can be adjusted by rolling or converting to other spread types. The key to success with vertical spreads is to size correctly, choose the right strikes based on technicals and volatility, and manage your risk by monitoring early assignment risk and having mechanical adjustment points based on delta or price. Suitable for conservative and aggressive traders, vertical spreads are the middle ground between buying options and multi-leg strategies.

Vertical Spread FAQs

What’s the main difference between a vertical and a horizontal spread?

A vertical spread has different strikes but the same expiration, a horizontal spread (also called vertical spread example on a calendar) has the same strike but different expirations. The term “vertical” comes from how options chains are displayed on trading platforms, with strikes arranged vertically. This allows you to create defined risk-reward scenarios based on price not time.

How do I calculate maximum gain and loss for a vertical spread?

For a debit vertical call option (bull call spread) your maximum loss is the net debit and maximum gain is the difference between strikes minus the net debit. For a credit vertical (bear call spread) your maximum gain is the net credit and maximum loss is the difference between strikes minus the net credit.

Why are vertical spreads better than buying options outright?

Vertical spreads have several advantages over single options: First, they require less capital because you’re selling one option to offset the cost of buying another. Second, they have built-in volatility protection since you’re long and short options. Third, they have defined risk, so position sizing and risk management is easier. Fourth, time decay can be minimized or even beneficial depending on the which vertical spread involves in.

When to use a bear vertical vs a bull vertical?

The choice between bear and bull verticals depends on your market view and the underlying’s technicals. Use bull verticals (call or put) when you expect moderate up and technicals show support holding. Use bear verticals (call or put) when you expect down and resistance holding. Consider market conditions, volatility levels and overall trend in your decision.

How do I manage verticals as they approach expiration?

As expiration gets closer, managing verticals becomes more critical due to gamma risk and assignment. Close positions when they’ve reached 50-75% of maximum gain. If a spread moves against you, you may roll to a later expiration or different strikes to manage risk. Always monitor positions in the last week before expiration as this is when assignment risk is highest, especially for credit spreads.

Can I leg into or out of verticals?

While possible, legging into or out of verticals (executing the long and short legs separately) is risky. The market could move against you before you complete both legs and you could end up with bigger losses than intended. It’s generally safer to execute both legs as a single order so you get the net credit and the risk-reward you want.

How does volatility affect verticals?

Volatility affects verticals differently depending on the spread. For debit spreads, more volatility helps your position, less volatility hurts credit spreads. But the effect is usually muted compared to single options because you’re long and short options. The spread’s vega (volatility sensitivity) is determined by the difference in strikes and time to expiration relative to the price of the underlying.

How do I calculate maximum profit and loss for a vertical spread?

For a debit vertical call option (bull call spread) your maximum loss is the net debit and maximum profit is the difference between strikes minus the net debit. For a credit vertical (bear call spread) your maximum profit is the net credit and maximum loss is the difference between strikes minus the net credit. The maximum loss for a vertical spread is limited to the net premium paid or received depending on the type of spread used.