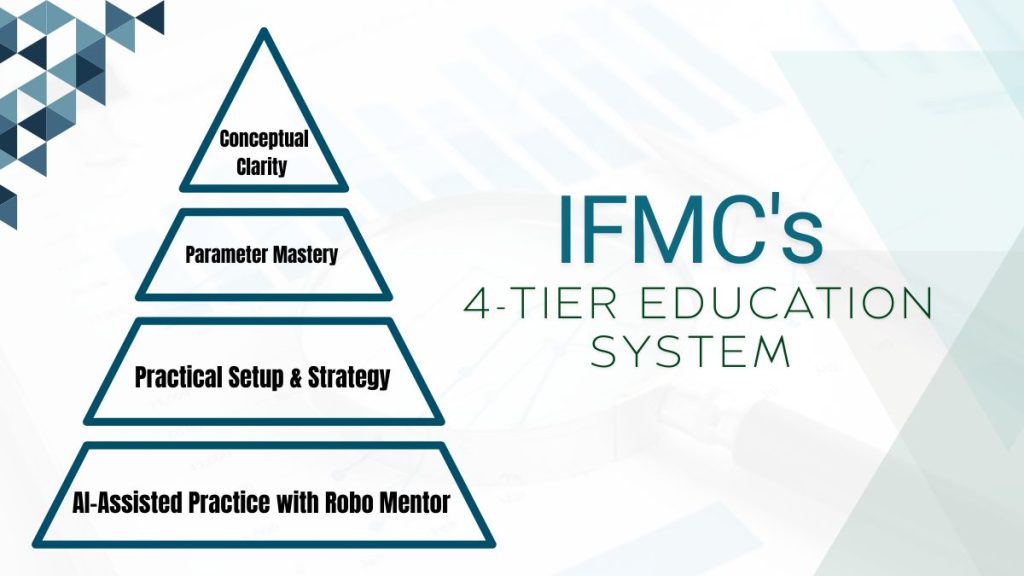

UDTS-VSM Two-in-One Learning Screener is a revolutionary tool that offers a quick and comprehensive insight into the long-term health of a stock. It is India’s first two-in-one screener that merges together fundamental and technical parameters for easy analysis. This innovative screener offers over 27 Fundamental and Technical parameters to filter stocks and get an instant overview of their performance.

UDTS-VSM (VALUE, SAFETY, MOMENTUM)

How to Analyze a Stock Before Buying: The Complete Guide to Analysis

When it comes to investing in stocks, there is a lot to consider and analyze before making any decision. Experienced traders and investors understand that researching the stock market requires an in-depth process in order to identify stocks with true potential. This process involves looking at macroeconomic factors, industry trends, financial metrics, and more.

Investing in the stock market can be a profitable way to increase your wealth, but it’s important to understand the fundamentals of analyzing stocks before investing. Having an understanding of financial analysis techniques, such as fundamental and technical analysis, can help you make smart decisions on which stocks to buy and when. Fundamental analysis involves assessing a company’s financial performance and health, while technical analysis looks at price and volume trends to try and predict future stock prices. Understanding how to apply these two methods can help you understand how a company is doing, allowing you to make more informed decisions when investing in the stock market.

When conducting fundamental analysis, it’s important to look at factors such as the company’s balance sheet, income statement, and cash flow statement. These financial documents give an indication of how the company is doing financially. It’s also important to review the company’s expenses, growth rate, profitability, debt level, and more.

So, continue reading below as we walk you through why it’s important to analyze a company’s stock before buying, and what methods to take in order to analyze a stock for yourself.

What Does it Mean to Analyze a Company Stock Before Buying?

Analyzing stocks before you purchase them is an essential part of a successful stock market strategy. It involves researching the company, such as looking at its financials and performance history, understanding the industry in which they operate, and taking into account any current or potential risks that could affect its future profitability. With this information in hand, investors can then decide whether the stock is a good fit for their portfolio.

In order to make wise and informed investment decisions, it is not enough to just consider the current stock price but it is also imperative that you undertake a thorough analysis of the financials of the stock, its competitive landscape, and its future prospects. This includes studying the balance sheet, income statement, and cash flow statement, and analyzing the metrics such as price-earnings ratio, dividend yield, and return on equity to identify the value of the stock.

Analysis of a company is an essential part of the stock market investing process and requires investors to examine both internal and external factors affecting the company’s share price. This means studying both quantitative and qualitative elements such as economic indicators, fundamental analysis, technical analysis, growth prospects, competitive environment, management team, and more. Doing so enables investors to assess the company’s value, potential risks, and future prospects. It is important to consider all these factors before investing in a stock, as they can help investors make more informed decisions and avoid unnecessary losses.

Is it Hard to Learn How to Analyze a Stock Before Investing?

Learning how to analyze a stock before investing is a difficult process that requires a great deal of research and dedication. It involves digging into complex financial statements, such as the company’s quarterly earnings reports, and making sense of the data presented. As such, analyzing stocks by hand can be both daunting and time-consuming.

Investing in the right tools to help with stock analysis is an invaluable asset. Not only can they streamline the process of analyzing shares, but they can also remove any guesswork or human errors that can arise. This can be especially beneficial for those who tend to let emotions drive their investment decisions, as a reliable stock forecasting tool can provide more accurate insights.

How to Analyze a Stock Before Buying: Step-by-Step Guide

When it comes to investing in stocks, it is important to understand how to analyze a stock before buying. There are various tools and methods that investors can use to determine whether the stock is worth buying, selling or holding. By understanding and using these methods, investors can get a better idea of whether they should invest in a particular stock and how much they should pay for it.

The first step in analyzing a stock is to gather and review the company’s financial statements. These include balance sheets, income statements, cash flow statements, and other documents that define the financial health of the business. These financial statements can provide insight into how much equity the company has and its current liabilities. They can also provide insight into how much revenue the company is generating and what its expenses are.

Another key part of analyzing a stock is looking at the company’s business model and strategy. This includes examining their past performance, current trends in their industry, and the general market conditions that could affect their future earnings. Investors can also use this information to gain insights into how the company is managing its assets, as well as its operations and expansion plans.

It is also important to consider the stock’s price-to-earnings ratio (P/E). This metric evaluates a company’s current market capitalization relative to its earnings per share. A low P/E indicates that there are fewer shares outstanding than earnings and suggests a better value.

Finally, reviewing the company’s management team is essential to analyzing a stock before purchasing. The goals, experience and track record of the current CEO and other top executives should be carefully reviewed. This can provide insight into the company’s plans for future growth and success.

By understanding the methods of how to analyze a stock before buying, investors can make more informed decisions about which stocks to purchase. By following these steps, investors can gain the confidence necessary to commit their capital and join the stock market.

Begin with High-Level Research

When you start to analyze a stock, it’s important to begin by gathering the necessary information and documents that will enable you to conduct a comprehensive research. To do this, you’ll want to obtain the company’s financial statements for the past few quarters, which can be found on their website or on other reputable sources. Having access to these documents is essential when looking at a company’s fundamentals, which we’ll explore in more depth below. With the right information in hand, you can begin to evaluate a stock’s worth and make informed decisions about your investment.

Next, take the time to familiarize yourself with the company’s industry and its competitors. Research where the company stands in the market, and look into any potential disruptive forces that could hurt its performance in the future. Keep an eye out for industry trends that could benefit or hinder the company’s growth, as well as any regulatory changes that might have an effect. Understanding these broader factors can give you a better idea of how your stock may perform in the long term.

In order to gain a more holistic view of the stock that is under consideration, it is important to take into account the analyst’s comments and recommendations as well as the financials. Even if these opinions are not in agreement with one’s own personal research, they can still provide insight and guidance on what to look out for while conducting an analysis.

Focus on the Financials

Once you have obtained all the essential financial data and information, it is time to analyze it in more depth. Fundamental analysis involves scrutinizing a company’s financial statements to gain an understanding of its performance and prospects. It involves looking at a variety of parameters such as the company’s revenues, assets, expenses, and liabilities to get an overall picture of the company’s financial health.

When conducting a fundamental analysis of a stock, investors utilize various metrics to determine whether a company is set for growth or if it is overvalued or undervalued. These metrics are often viewed in comparison to the candle charts utilized in intraday trading, as they provide some insight into the current performance and future potential of an organization’s stock.

Some of these commonly analyzed metrics include:

EPS, or Earnings per Share, is an essential measure of a company’s financial performance. It is calculated by taking the total earnings of the company and dividing it by the number of shares trading on the market. This metric provides investors with an indication of their potential return on their investment in the company. In addition to this direct measure of return, the EPS can be used to compare a company’s financial performance against that of its peers in the industry. This metric can also provide investors with valuable information on how efficiently the company is utilizing its capital and whether it has experienced any improvements or declines in profitability over recent quarters.

P/E Ratio: Analysing the price-to-earnings (P/E) ratio of a stock is an essential part of any investor’s due diligence process. This ratio provides investors with an indication of the discounted present value of a company’s future earnings and helps to demonstrate how much investors are willing to pay for $1 of its current earnings. By using this metric, investors can gain an understanding of whether the stock is overvalued or undervalued at the current market price. Analyzing the P/E ratio is a great way to compare companies operating within different industries and regions. For example, if company A’s P/E ratio is higher than company B’s, this may indicate to investors that company A is more profitable and has a brighter future outlook than company B.

PEG Ratio: The PEG ratio, or price-to-earnings-to-growth ratio, is a metric that many investors use to measure the value of a company. Unlike the traditional P/E ratio, the PEG takes into account expected earnings growth during a certain time period. A lower PEG generally implies that the stock is undervalued and could be a good opportunity to buy, while a higher PEG implies the opposite. A company’s PEG is an important metric to consider when assessing whether it is undervalued or overvalued.

Dividend Yield: The dividend yield is an important metric for investors to consider when evaluating a stock. Dividend yields are typically expressed as a percentage of the current stock price and can provide a valuable source of extra income for shareholders. Generally speaking, higher dividend yields tend to be more attractive to investors. To calculate the dividend yield, one simply needs to divide the quarterly dividend by the current stock price. It is important to note that not all stocks pay dividends, and those that do can change their dividend payments over time. Investors should always take into account the company’s history of dividends before investing. In conclusion, there are a variety of metrics investors can use when evaluating a stock. Fundamental analysis is an essential part of stock analysis and can help investors identify potential investments that may offer attractive returns. Investors should also consider the company’s valuation, earnings growth, and dividend yield when evaluating a stock. By using these metrics to their advantage, investors can make well-informed decisions when it comes to investing in stocks.

Consider Qualitative Factors

In addition to the fundamentals analysis of a company’s shares, it is important for investors to understand the technical factors that may also be affecting a stock’s performance. Technical analysis looks at the trading patterns and price movements of security to gain insight into future performance. This includes using historical data to identify trends in trading behavior, charting patterns, and other indicators to gauge how the stock may behave in the future. Technical analysis can provide investors with a better understanding of market sentiment, risks, and opportunities for investing in a particular security.

For example, analyze the business model of the company, and really get to know how they make money. If it’s unclear to you, it’s too complex, or they’re operating in a dying industry with no plans to pivot, you may end up more bearish on the shares than what the fundamentals might suggest.

When analyzing a company’s business model, it is important to dig deep and gain an understanding of how they generate its revenue. It can be helpful to ask questions like what new products or services are they developing? Is there a trend in their sector that could benefit the company? Seeing that the company has plans for growth may give some assurance when considering an investment.

When analyzing a company stock, qualitative factors must be given substantial consideration. Fundamental analysis provides an excellent starting point for understanding the value of a particular stock, however, these results should not be taken as definitive. Qualitative factors provide additional information to support or contest the conclusions drawn from fundamentals. These considerations can include management structure and changes therein, the company’s industry and the competitive landscape, public perception of the company’s products or services, legal compliance issues, technological innovations, and many other factors. All of these elements can have a major impact on how a company is valued and its stock price.

How to Make Stock Analysis a Task of the Past With UDTS-VSM

With the help of UDTS-VSM, stock analysis can become a task of the past. It takes away the technical jargon and provides investors and traders with all the information they need to make an informed decision about their investments. Gone are the days when investors needed to conduct intricate fundamental and technical analyses for each individual stock, or even for an entire portfolio. Now, with UDTS-VSM, all of this information can be accessed in one place.

The greatest benefit of UDTS-VSM is the time it saves investors and traders – they no longer need to spend hours going through financial statements or trying to decipher technical charts. Instead, they can get a comprehensive overview of the stock and its performance by simply inputting a few key pieces of data. With this information, investors and traders can accurately assess the risks associated with their investments and make smart decisions quickly.

At the same time, UDTS-VSM also helps investors to track the performance of their portfolios over time. By providing real-time pricing and performance data, investors can be sure they are making the right decisions with their investments. They can also keep a close eye on their portfolios and make changes as needed without waiting for days or weeks for market updates.

Ultimately, UDTS-VSM helps to make stock analysis easier and more efficient than ever before. With this revolutionary system, investors and traders can make informed decisions quickly, accurately assess the risk of their investments, and keep a close eye on their portfolio performance. By making stock analysis simpler and more efficient, UDTS-VSM is helping investors to save time and money so they can focus on what really matters: growing their wealth. So don’t wait – start taking advantage of UDTS-VSM today to make stock analysis a task of the past.

UDTS-VSM provides a quick view of more than 27 fundamental and technical parameters with peer comparison. That makes your research easier and more self-reliant.

Our platform eliminates the guessing game for investors and traders. Spend less time in front of your screen, and more time cashing in!

Final Thoughts on How to Analyze a Stock Before Investing

Studying how to analyze a stock is an imperative part of investing, however, it can be quite challenging and time-consuming. Nevertheless, earning a profit in the market does not need to be complicated. Utilizing the proper techniques and doing your due diligence can help you develop a successful portfolio that yields great returns no matter the economic conditions.

With UDTS-VSM, investors and traders have the upper hand in the markets and can access clear and up-to-date information for any stock at any time.

Try UDTS-VSM today and easily discover which stocks are UNDERVALUED, SAFE, AND READY TO MOVE.