Best Institute for Stock Market Training & Trading Courses

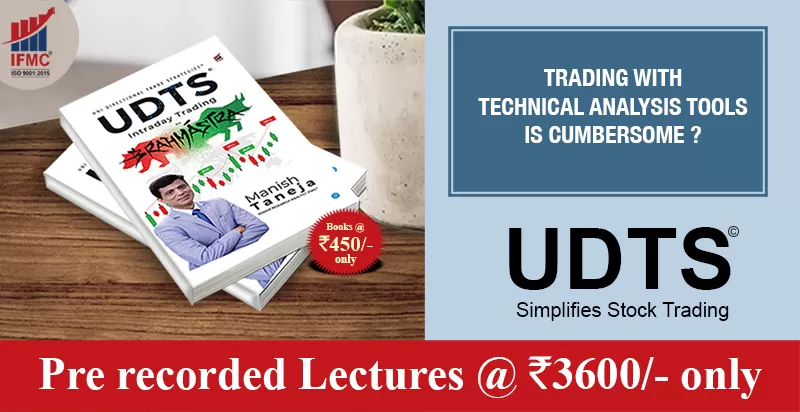

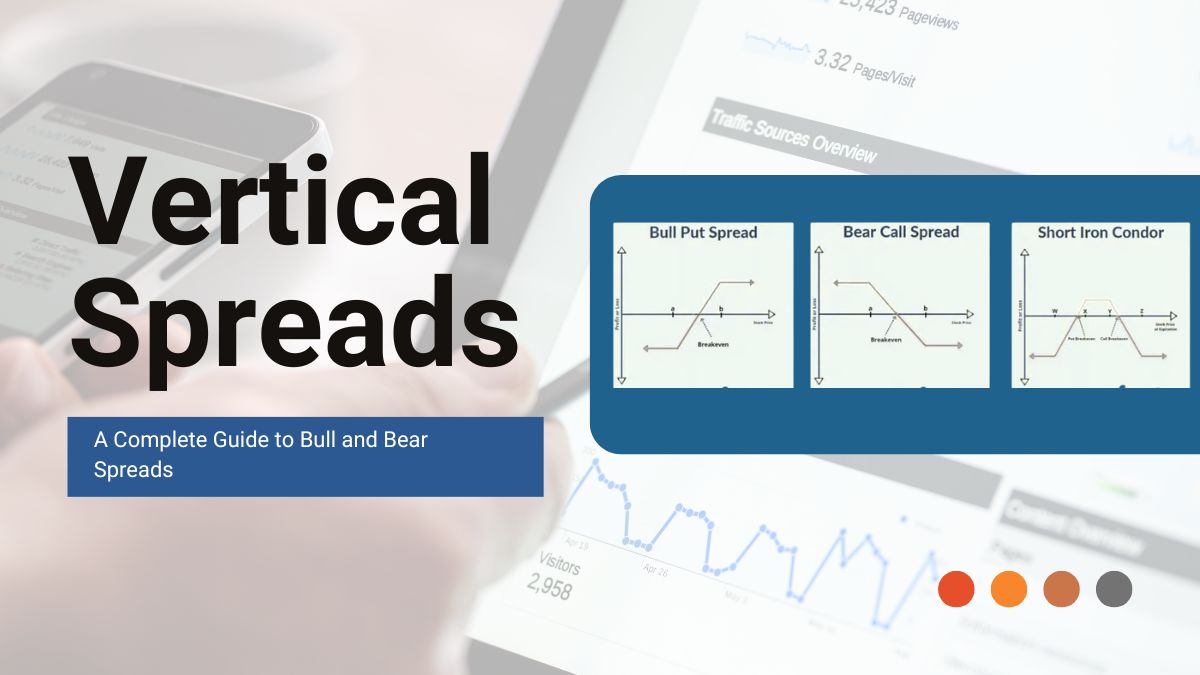

Welcome 😊😊 to India’s #1 and best stock trading institute. IFMC® is the best trading institute in India for online and classroom share market courses for beginners and professionals in India. Specially designed stock market courses with the help of its copyright strategies to understand the cumbersome tools of Technical Analysis, Options Strategies, and fundamental analysis make IFMC leaders in stock market education. Prepare for certification courses offered by Indian stock exchanges NSE, BSE, NISM, NCFM to make a growing career in the share market industry. World-class learning tools and our book on intraday trading “UDTS-Intraday Trading Brahamastra” give an edge over others to teach a common man how to trade with confidence and simplicity. We have more than 20 Advance Stock Market Courses & trading strategies. We are glad to announce that IFMC has got YouTube Silver Play Button for surpassing 2,00,000+ subscribers & over 13 Million viewers.

USP OF IFMC® INSTITUTE DELHI

IFMC® is ISO Certified Stock Market Institute

IFMC® is Pioneer & has a monopoly on Stock Market Courses.

IFMC® is the only Institute having its own copy write Trading Strategies UDTS ©️& M.A.D.E.©️

IFMC® has its own Softwares & Learning Screeners for Intraday, Positional, long positional and Investments that makes learning more easier.

IFMC ®️has its own book UDTS ©️Intraday Trading Brahamastra -A comprehensive guide for all beginners, traders & investors.

IFMC® has a belief of 12 Million plus learners associated with IFMC®

Best Reviews on YouTube and social media (Reviews in lakhs),

Practical training in Live Market.

Classroom Training

Your search for the best share market institute ends at IFMC. IFMC has its branches in Delhi & NCR, It is India’s top-rated for share market education. IFMC has nearly 22 various courses in various combos to meet the need of ....

Learn moreOnline Courses

India’s best online stock market learning platform for Beginners, Students, Housewives, and Professionals, who wish to learn to trade and invest in the stock market within the comforts of their home or upgrade their skills side by side with graduation.

Learn moreUSP OF IFMC® INSTITUTE

IFMC ®- Is Best Stock Market Training Institute in India.You are investing in Knowledge.

IFMC ® is ISO Certified Institute of Stock Market

IFMC ® is Pioneer & has a monopoly on Stock Market Courses & Trading techniques.

IFMC ® is the only Institute having its own copyright Trading Strategies UDTS ©️ & M.A.D.E. ©️

IFMC ® has its own unique teaching Tools to understand the concept of Trading & Investment.

IFMC ®️ has its own book UDTS ©️ Intraday Trading Brahamastra - A comprehensive guide for all beginners, traders & investors.

IFMC ® has a belief of 13 Million plus learners associated with IFMC ®

IFMC ® - Has Best Reviews on YouTube and social media (Reviews in lakhs).

IFMC ® - Emphasis on practicals, tests, viva & Projects.

Why Should You Join IFMC ®

Best Stock Market Career Courses by IFMC

IFMC® ही क्यों?

- IFMC Stock Market Institute Has 100% Placement Record

- Gain 100% Confidence to Trade in Financial Market

- Unmatched Trading Strategies UDTS©

- Practical Training

- Best Stock Market Courses Online

- 20 Plus Stock Market Trading Courses

- Get Mentored by Sr. Research Analyst Mr. Manish Sir

- Short Term Trading Course

- Only Institute with Copyright Strategies

- Beginners to Advanced Courses

- Experienced Faculties

- Learn to Trade with Accuracy

LEARNING TOOLS AND RESOURCES

UDTS © - VSM

THE FUNDAMENTAL LEARNING SCREENER

- Learn Stock Analysis With World Class Market Guidance Screener

UDTS ©

INTRADAY LEARNING SCREENER

-

Get Started With 1 Month, 3 Months,

6 Months and 12 Months plan.

MOCK TEST-PRACTICE QUESTIONS PAPPERS FOR NSE, SEBI, NISM, NCFM CERTIFICATION

Entry Exit का खेल

Why is UDTS So Popular Amongst Stock Market Traders?

UDTS Best Intraday Trading Course

IFMC ONLINE & CLASSROOM STOCK MARKET INSTITUTE IS BENEFITING

-

Stock Market Traders Losing Money in Stock Market

-

Anyone who wants to trade in Indian Stock Market for Extra Returns.

-

Housewives and Retired Professionals

who want to Generate

Extra Income.

-

Anyone who wants to be a consultant and sub-broker.

-

Students of CA / CS / ICWA / CFA who want to upgrade their knowledge.

-

After Graduation / Post Graduation / MBA - Skilled Training Course for Quick job / Career Oriented Courses on Stock Market.

IFMC CHANNEL