Investing in the stock market is one of the most significant opportunities to generate wealth. For many, the idea of buying shares in a publicly traded company seems daunting. But with knowledge, the stock market can be a powerful force to fuel financial growth.

In this blog, we explore when it’s the right time to invest in the stock market, which parameters determine the stock prices, and how to make an informed choice to enhance your chances of gain.

Understanding Stock Market Basics

Let’s first consider the basics of investing. When you buy stocks, you are buying a very tiny share of ownership in a company. When the company prospers and progresses well, the value of stocks you purchased may also rise, and you can sell them for a profit.

The price of the stocks changes according to several considerations, including economic conditions and how a company is performing. Therefore, informed choices-the right time to buy and sell-one should make to be successful in investing.

When to Invest in Stocks?

It cannot be easy to time the stock market perfectly, even for the most seasoned investors. But there are certain strategies and key points that can help one make more informed decisions at all times. Here are some factors to take into account when considering investing in the stock market:

1. Investment during Low Stock Price

Buy stocks when their prices are low. Stocks that cost less can bring out the most returns since there may be more room for growth of the stocks. Conversely, high prices for stocks tend to be overpriced, and the risk for them to dip in price is greater.

While low-priced stocks have further downward price potential, they still represent the potential for long-term growth. The important thing is to research the stock thoroughly and make sure that it has potential to be profitable in the future.

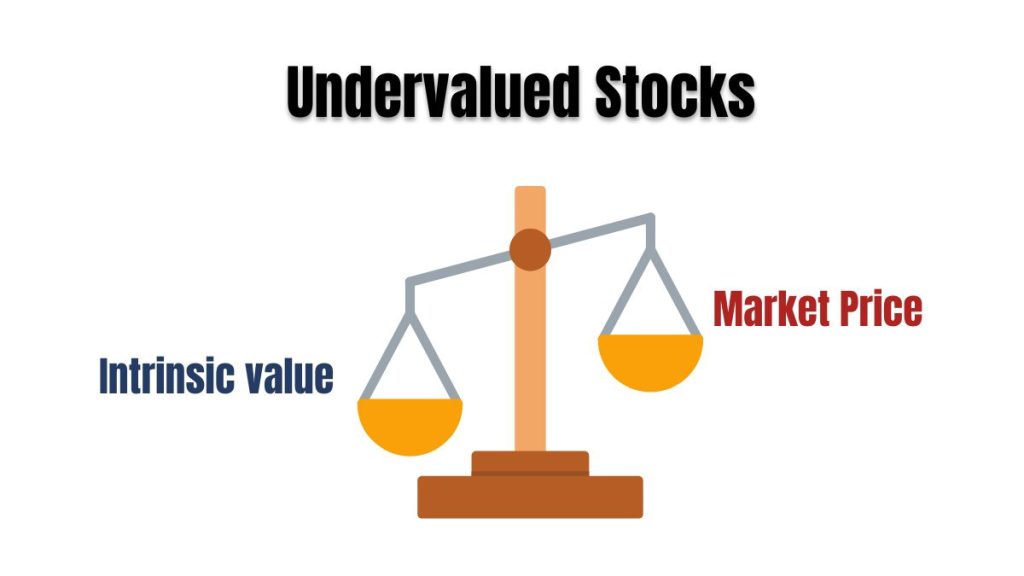

2. Undervalued Stocks

Undervalued stocks refer to stocks priced cheaper than their intrinsic value. Sometimes, overreaction to bad news makes the prices go down. Another case is when undervalued companies are valued lower by the investors.

Secondly, undervalued stocks can only be identified with a firm understanding of a company’s financial health and potential future. Two common metrics used to help determine whether a stock is undervalued or overvalued are Price-to-Earnings (P/E) ratio, Price-to-Sales (P/S) ratio, and the lesser-known, yet equally informative Price-to-Cash-Flow ratio.

Finding undervalued stocks can potentially make one benefit from their long-term growth since the market adjusts over time.

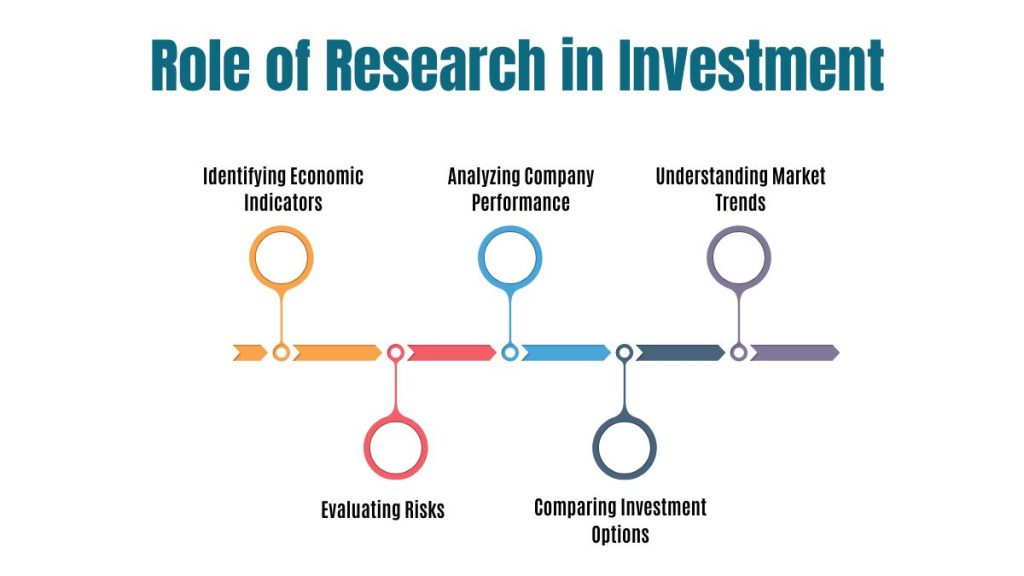

The Role of Research in Investment

Research is the backbone of any successful investment strategy. Knowing when to buy a stock is just as crucial as knowing how it might grow. One must research completely on the company and its market conditions before making any investment decision.

Some crucial research topics are:

Company Reports: Most publicly listed companies publish annual reports that provide detailed insights into their financial performance, business strategies, and future plans. Reviewing these reports can help you assess the company’s stability and growth potential.

Market Conditions: Market conditions also dictate stock prices. Economic downturn generally brings down the market as whole, while periods of economic growth generally result in higher stock prices. Knowing these trends will help you make wiser investment decisions.

Best Time of Day to Buy Stocks

Whereas the stock market runs at specific times (for Indian markets, often between 9:30 AM and 3:15 PM), not every minute of the trading day is just right for purchasing stocks. Moreover, some time may be better than others.

Early Morning Hours: 9:30 AM-10:30 AM

Intraday traders, therefore, prefer to buy and sell stocks at the start of the trading session that includes extreme volatility. The market reacts to overnight news and events, so there may be sharp movements in the stock price. Thus, most traders let the adjustment occur during the first 15-30 minutes before finalizing a major decision.

However, it is also stressful for a beginner since this period may see frequent impulsive decisions based on market fluctuations. It’s always advisable to keep calm and wait for the market to stabilize.

Midday Time: 12:00 PM to 2:00 PM

In general, during lunchtime, the stock market tends to be less volatile, and trading volumes usually decline. It can be a good time for investors to measure the market in a calmer mood and decide more judiciously.

End of Day: 2:30 PM to 3:15 PM

The last hour of the trading day usually indicates that traders are ramping up for the closure of the market day. Thus, closing time is generally a busy hour for market dealings. However, this does not necessarily mean that it is critical for long-term investors because the end provides an excellent opportunity to track the market’s movement and make adjustments in strategies.

The Role of Market Trends in Timing Your Investment

Market trends and the nature of the economic cycles will determine the appropriate time to make an investment. Broadly, the markets go through bull markets-growth periods-and bear markets-decline periods. Each cycle brings forth different opportunities for investors.

Bull Markets (Rising Market)

A bull market is characterized by rising stock prices along with high investor confidence. At this point, it can be so tempting to jump into the market because the price seems to rise continuously, but purchasing at the peak of a bull market can really expose you to enormous risk if the market starts to reverse.

Bear Markets (Falling Market)

A bear market is when stock prices are falling. Though it sounds like a terrible time to invest, bear markets provide a great opportunity to purchase undervalued stocks at lower prices. If you have a long enough horizon for investment, then you should look forward to bear markets because you can acquire shares at discount prices.

Key Tips for Timing Your Investments

Few strategies guarantee that a person can time the market perfectly. Still, some will minimize their bad decisions by employing:

1. Dollar-Cost Averaging (DCA)

Dollar-cost averaging is where you invest an equal amount of money at regular intervals, regardless of the prevailing stock price. In the long term, this strategy smoothes out market fluctuations and reduces the risk associated with investing a substantial sum at the wrong time.

2. Be Alert to Market Indicators

Markets have an array of indicators which show whether the market will be bullish or bearish. For example, the interest rate, inflation, and GDP growth can tell where the market is headed. Knowing what’s happening in each of these areas helps you better time your investments.

3. No Emotional Decisions

It’s natural to feel like buying when the market is booming or selling when it is crashing, but emotional decisions often lead to bad investment outcomes. Instead, concentrate on your long-term goals and stick to your investment plan.

Conclusion:

The right time to invest has nothing to do with wishing to predict the future or to time the market correctly. It’s about:

•Having an investment strategy

•Doing proper homework on your stock

•Capitalizing on underpriced available opportunities

•Having a long-term focus

Following these principles and understanding the larger market trends puts an individual in a better position to make better decisions in terms of where to invest wisely.

Start by investing early, keep going with consistent investment, and remember that investing is a marathon, not a sprint. Whether the market will go up or down, still, it will be more important to create a diversified portfolio that gets in line with your financial goals since that’s normally where the money is.

FAQs On The Right Time To Invest In The Stock Market

When is the best time to start investing in the stock market?

The best time to start is as soon as possible. The earlier you invest, the more time your money has to grow. It’s not about timing the market perfectly but starting your investment journey and staying consistent.

Should I buy stocks when prices are low?

Yes, buying low-priced or undervalued stocks can be a good idea, but only if the company has strong growth potential. Do your research to ensure the stock is worth investing in before making a decision.

How do I know if a stock is undervalued?

Undervalued stocks are priced lower than their actual worth. Check the company’s financial health and use tools like the Price-to-Earnings (P/E) ratio to see if it’s a good deal.

What’s the safest way to invest without risking too much?

You can use the dollar-cost averaging strategy, where you invest a fixed amount regularly. This reduces the risk of buying at a high price and balances out market ups and downs over time.

How can I avoid making emotional investment decisions?

Stay focused on your long-term goals and stick to your plan. Don’t rush into buying when prices rise or panic-sell when they drop. Research, patience, and discipline are your best tools.