When experienced options traders look at trading opportunities they don’t just look at stock price movements – they look at implied volatility (IV). Implied volatility is a powerful metric that shows the market’s collective wisdom and assesses market sentiment and expectations of future price movements. Think of implied volatility as the market’s crystal ball that shows you expected stock movement and trader sentiment that isn’t visible on price charts.

What is Implied Volatility?

Implied volatility (IV) is the market’s expectation of future price fluctuations or movements of a financial instrument (stock or option). It’s a key factor in determining the price of an options contract and is used by investors to measure the risk and reward of options trading. Implied volatility is a percentage of the stock price and is a live figure that changes based on options market activity.

Implied Volatility Basics

Implied volatility is the market’s forecast of how much an underlying will move over a certain period. Unlike historical volatility which looks back at past price movements, implied volatility is forward-looking, derived from current options prices using models like the Black-Scholes model.

To calculate implied volatility traders use models like the Black-Scholes model which includes factors like current stock price, strike price, time to expiration, and risk-free interest rates.

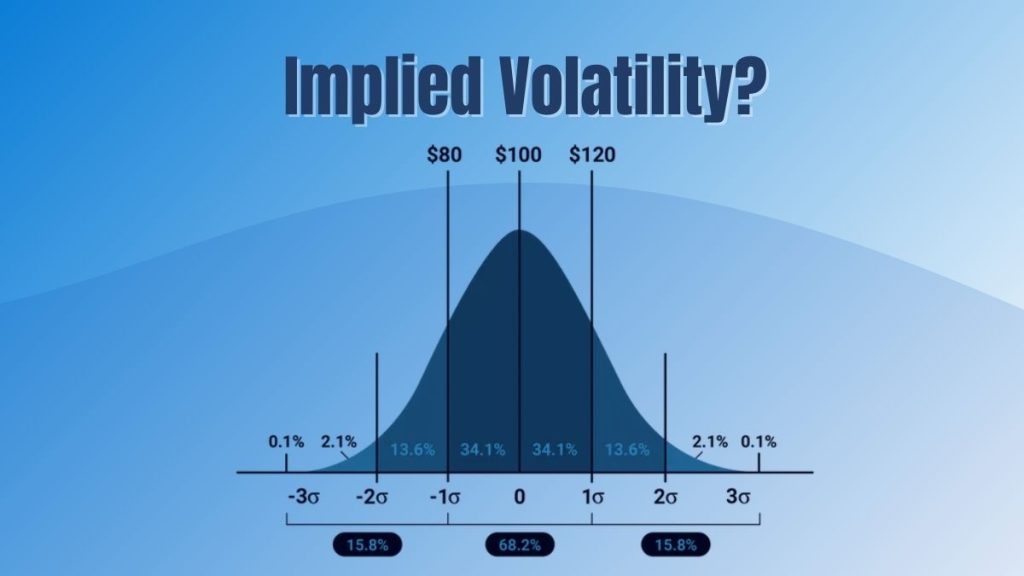

To understand this think of it like trying to predict how much a stock market price will move over the next year. If a stock has an implied volatility of 30% the market expects the stock to be within plus or minus 30% 68% of the time (one standard deviation). This statistical measure helps traders gauge market sentiment and make better trading decisions.

Historical Volatility vs Implied Volatility

Historical volatility (HV) and implied volatility (IV) are both measures of volatility in the price of an underlying but they are different in perspective. Historical volatility looks back at past price movements, and implied volatility looks forward at future price movements. Historical volatility is calculated from past data, implied volatility is derived from the current options market. Understanding the difference between historical and implied volatility is key to making better investment decisions.

Implied Volatility and Options Pricing

Implied volatility is a key component of options pricing. It’s used to calculate the premium of an options contract and is a factor in the price of an option. in price Options contracts with high implied volatility have higher premiums and options with low implied volatility have lower premiums. Implied volatility is also used to determine the strike price of an option which is the price at which the option can be exercised.

Black-Scholes Model and IV

The Black-Scholes model is an options pricing model that includes the current stock price, options strike price, time to expiration, and risk-free interest rates. The model calculates the implied volatility of an option which is then used to price the option. The Black-Scholes model is a complex mathematical formula that takes into account many factors that affect the price of an option.

How Market Forces Impact Implied Volatility

Several factors impact implied volatility. When market participants expect big events like earnings announcements or natural disasters implied volatility tends to go up as traders expect bigger price movements. This uncertainty leads to higher option premiums, especially implied volatility decreases in the extrinsic value component of options contracts.

On the other hand, when implied volatility goes down after a trade it usually means option prices go down which benefits option sellers and hurts option buyers.

Let’s consider a real-world example: Stock XYZ is trading at ₹1,000 and its options have an implied volatility of 20%. The company announces unexpected leadership changes and implied volatility shoots up to 40% as traders buy options for protection or speculation. Even though the underlying stock price hasn’t moved, implied volatility example up much.

What does Implied Volatility mean

Implied volatility requires an understanding of the underlying price movement and the market’s expectation of future price movement. Implied volatility can be used to gauge market sentiment and determine the risk and reward of trading options. High implied volatility means the market expects the underlying to move big, and low implied volatility means at the money the market expects the price to be stable. By understanding implied volatility you can make better buying and selling decisions.

Trading Applications and Strategy

Implied volatility is more useful when developing options trading strategies. When implied volatility is high options sellers benefit from higher premiums as the future value of the option price increases due to bigger price movement, when implied volatility is low options buyers might find opportunities.

Long-term bulls might look to sell covered calls when implied volatility is high and take advantage of the higher premiums. Fund managers often use options with high implied volatility as hedges during uncertain market conditions.

Advanced Volatility and Historical Volatility Analysis

For advanced traders implied volatility analysis goes beyond the basics. The relationship between strike price and implied volatility creates patterns known as volatility skew or smile. These patterns reveal important information about market sentiment and risk perception.

Realized volatility also known as historical volatility is the past price movement of a security, and implied volatility is the future price movement based on market expectations.

Statistical volatility helps traders compare current implied volatility to historical norms and find opportunities when implied volatility is high or low. This is a key tool for professional options traders who manage complex positions.

How to use Implied Volatility in practice

To use implied volatility in your trading:

- Always check implied volatility before you enter options positions to know what the market expects from future price movement

- Compare current implied volatility to its historical range

- Think about how upcoming events will affect volatility

- Adjust your strategy based on high or low implied volatility

- Watch how implied volatility changes affect your positions

Implied volatility tends to mean stable prices will revert over time, extremely high or low levels don’t last forever. This is where experienced traders make money.

Risk Management and Position Sizing

Risk management is more important when trading options with high implied volatility as it reflects the market’s expectation of bigger price movement. Higher premiums mean bigger losses if you’re wrong. Professional traders reduce position size when implied volatility goes up to maintain the same risk.

Market makers and institutional traders use complex models to calculate implied volatility across different strike prices and expiration dates. This gives them a complete picture to find mispriced options and arbitrage opportunities.

Summary

Implied volatility analysis will change the way you trade options. Instead of just reacting to price movement you’ll start to understand and anticipate market behavior through implied volatility work. Whether you’re selling options for premium or buying protection for your portfolio implied volatility is the key to timing your trades and choosing the right strategy.

Start by monitoring implied volatility in a few stocks you’re familiar with and see how it changes around events and market movement. With time you’ll develop an instinct of how it affects options prices and trading behavior. Remember successful an options strategy and trading isn’t just about predicting price direction – it’s about understanding and using the market’s expectation embedded in implied volatility.

Implied Volatility IV

Implied volatility (IV) is a key metric in options trading that measures the market’s expectation of future price movement of an underlying asset, expressed as a percentage over a year. Unlike historical volatility that looks at past price movement, IV is forward looking and calculated from current options prices using models like Black-Scholes. It’s a must have tool to gauge market sentiment and time your trades. When IV is high, it means traders expect big price movement and higher options premiums, when IV is low it means market is stable and lower premiums. Implied volatility is essential for options traders to choose strategy, manage risk and find opportunities – whether they’re selling options during high IV to capture premium or buying options when IV is low to benefit from future volatility expansion. Understanding IV helps traders not just react to price movement but anticipate and profit from market behavior through volatility expectation.

Implied Volatility in Options Trading FAQs

What is implied volatility in simple terms?

Implied volatility (IV) is the market’s forecast of expected volatility – how much a stock will move up or down in the future, expressed as a percentage. Think of it like a weather forecast – instead of predicting rain, it predicts price movement. For example, if a stock has 30% IV the market expects the stock to move up or down 30% over the next year with about 68% probability.

How does implied volatility affect option prices?

Higher implied volatility means higher option prices (premiums) and lower implied volatility means lower equity prices and premiums. This is because more expected stock price movement means more value in the option. For example, a ₹1,000 stock – if the market expects big price swings (high IV) traders will pay more for options because there’s more chance they’ll be in the money.

What’s the difference between historical and implied volatility?

Historical volatility measures past price movement and implied volatility measures future movement. It’s like driving a car – historical volatility is looking in the rearview mirror to see where you’ve been, and implied volatility is looking through the windshield to see where you’re going.

How do I know if IV is high or low?

You can compare the current IV to the stock’s historical IV range or check the IV percentile. For example, if a stock has an IV in the expected range of 20-40% and the current IV is 38% that would be high. Many trading platforms have IV rank or percentile indicators to make this comparison easier.

When should I buy options vs sell them based on IV?

Generally, traders prefer to sell options when the IV is high (and likely to decrease) and buy options when the IV is low (and likely to increase). This is the trading principle of “buy low sell high” applied to volatility instead of price. But this should be just one of the factors in your trading decision along with directional view, time horizon, and risk management.

Does IV predict market direction?

No, IV only predicts the magnitude of movement current market price, not the direction. High IV means the market expects big moves but doesn’t tell you if those moves will be up or down. It’s like knowing a storm is coming but not knowing if it will bring rain or snow.

How does earnings season affect IV?

IV usually when implied volatility increases much leading up to earnings announcements and then drops sharply after, this is called a “volatility crush”. This happens because earnings reports create uncertainty about price movement but once the news is out that uncertainty goes away. Many options traders plan strategies around these predictable IV patterns.

Can IV help with risk management?

Yes, IV is a risk management tool. A higher IV means the market expects bigger price movement, which means smaller position sizes and wider stops. Professional traders adjust their position sizing based on IV levels to maintain consistent risk exposure across different market conditions.

What causes IV to change?

IV changes based on option supply and demand, market uncertainty, upcoming events (earnings, FDA approvals), broader market sentiment, and macroeconomic factors. Big news events, market crashes, or periods of economic uncertainty usually determine implied volatility and lead to higher IV levels.

How is IV calculated?

IV is calculated from options prices using the Black-Scholes model or similar models. While the actual calculation is complex (strike price, time to expiration, interest rates, etc) most trading platforms calculate IV for you. Traders usually just use IV rather than calculate it themselves.