Making smart investment advice requires the right skills and deep knowledge of diverse options. The Securities Exchange Board of India (SEBI) mandated for students to qualify the NISM certification courses for aspirants ambitious to make a career as an investment advisor in India Stock Exchange.

The benefit of the certification is that you can apply for jobs in various sectors like finance, insurance, banking, corporates, etc. After getting the certificate you apply for the profit of broker, investment advisor, financial planner, equity dealer, wealth manager, etc.

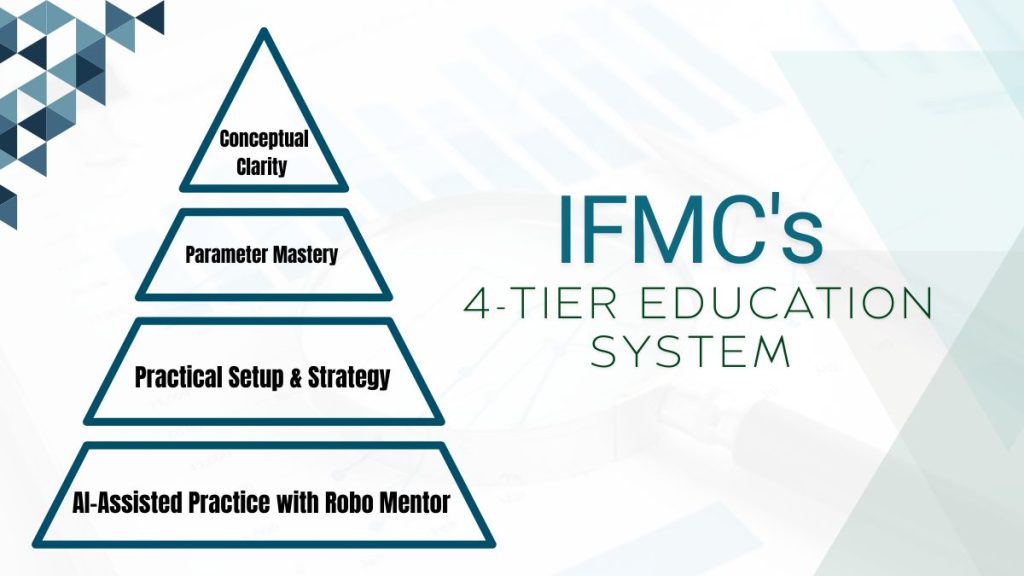

Today, an investment adviser is one of the booming career options. But few students clear the exam. IFMC follows the current guidelines issued by the government of India offering a webinar on Investment Advisor. Stock market investment courses

About Webinar

It is a short-term webinar (30 to 60 days) to prepare students for the upcoming NISM investment advisor level 1 examination. The online webinar aims to help students clear the NISM certification in investment advisor certification. This program covers everything you need to learn about investment and related products like stock trading, investing, savings, mutual funds, equities, bonds, insurance, FDs, etc.

Check ALSO: Investment and portfolio management courses

To Book Your Slot Call: 9870510511

Batch Starting From: 18th September 2020

Why Should You Attend?

- One-to-one online study

- Theoretical and practical knowledge

- Experience faculty

- Latest curriculum

- Placement and internship guidance

- Practice throat NISM mock test

Who Should Attend?

- Investment adviser and their associates, representatives or partners

- Students seeking a job as an investment advisor, financial planner, mutual fund advisory, wealth manager, fund manager

- Working professionals who want to learn different investment options

- Housewives and retired officers who want to learn how to invest and grow their money

Module 1

- Introduction to an investment advisor

Module 2

- Overview of the financial market Part 1

Module 3

- Overview of the financial market Part 2

Module 4

- What is the securities market? Part 1

Module 5

- What is the securities market? Part 2

Module 6

- What is a Mutual Fund? Part 1

Module 7

- What is a Mutual Fund? Part 2

Module 8

- What is a Mutual Fund? Part 3

Module 9

- What is a Mutual Fund? Part 4

Module 10

- What is a Mutual Fund? Part 5

Module 11

- What is a Mutual Fund? Part 6

Module 12

- What is a Mutual Fund? Part 7

Module 13

- What is a Mutual Fund? Part 8

- What are the different types of investment options?

- Equity Funds

- Sectoral Funds

- Theme Funds

- ELSS

- Short Term Debt Funds

- Guild Funds

- FMP Funds

Module 14

- What is Investment Products

- Different types of Investment Products

- Asset Allocation

- Small Saving Investment

- PPF

- NSC

- SCSS

- Post Office Scheme

- KVP

- Sukanya Samriddhi Account

Module 15

- Types of Investment Schemes

- Sovereign Gold Bonds Scheme

- Gold Monetisation Scheme

- Govt Securities Bond

- Derivative

- Option

- Real Estate

- ETF

Module 16

- Investment Risk Management

Module 17

- Measuring Investment Returns part-1

Module 18

- Managing Investment Returns part-2

- Concept of Compounding

Module 19

- Managing Investment Returns part-3

- What is the XIRR Function in Excel?

Module 20

- Concept of Financial Planning Part-1

Module 21

- Concept of Financial Planning Part-2

Module 22

- Concept of Financial Planning Part-3

Module 23

- Concept of Financial Planning Part-4

- Risk Profitability

Module 24

- Asset Allocation and in Strategies

Module 25

- Insurance Planning part-1

Module 26

- Insurance Planning part-2

Module 27

- Insurance Planning part-3

Module 28

- Retirement Planning part-1

Module 29

- Retirement Planning part-2

Module 30

- Tax & Estate Planning part-1

Module 31

- Tax & Estate Planning part-2

Module 32

- Tax & Estate Planning part-3

Module 33

- Tax & Estate Planning part-4

Module 34

- Tax & Estate Planning part-5

Module 35

- Regulation of an Investment Advisor part-1

Module 36

- Regulation of an Investment Advisor part-2