Do you want to know the best ways to learn intraday trading online? Do you want to become an intraday trader?

In this article, find simple tips and a list of popular learn intraday trading course.

Fortunately, there are hundreds of free and paid intraday trading courses that can help you build the skills you need to become a smart intraday trader. But finding the right course for yourself can be complex. This is why we have compiled an article for beginners who are looking for how to study intraday trading basics and find more about popular courses on learn intraday trading online. Let’s get started!

Getting Started With Learn Intraday Trading

Many people enter intraday trading with the wrong intent to make quick money without any professional knowledge. Not to mention, intraday trading is not a piece of cake. It’s one of the most demanding and challenging professions that henceforth requires a tremendous amount of dedication and hard work.

But firstly, you need to get out of the misconceptions. If you believe you know ‘how intraday trades work’, then there are only 10% chances that you can learn about intraday trading. As a disciplined day trader, it becomes crucial to know key terminologies.

This is a complete guide for beginners that will train you on intraday trading in the fastest way possible.

Introduction

Let’s first understand – what is intraday trading?

Trading strategies by IFMC is a technique deals with buying and selling of securities within the same day. The securities can be in a form of currency, options, commodities or etc. However, trades are not kept on hold overnight. Rather they are squared off by the end of the day.

Here, traders get involved in buying and selling stocks with an intention to get success. And not with the intent to invest for the long-term.

It also avoids traders from the losses caused by overnight events that cover after the market is closed. With the right intraday trading strategies, you can make immediate money with market volatility. Many people consider gambling as a value investment. However, one can make huge money in the stock market by practising trading rules to survive and can make career in stock market.

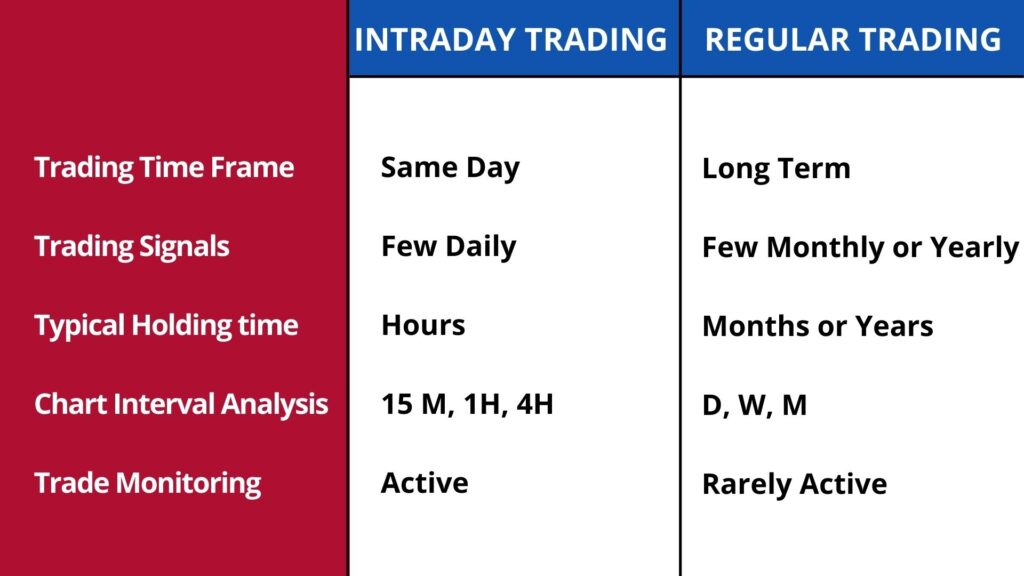

Difference Between Intraday & Regular Trading

The only difference between intraday trading and regular trading is the way it lies in the process of stock delivery. During Intraday Trading, you retain your position on the same day as a result of selling orders offsets your buy order. This results in no transfer of shares ownership. Over the span of time, a regular trade gets settled.

Consequently, you get delivery of the shares you own and the shares you sold out get moved out from your Demat account.

As you now know basic of intraday trading, let’s understand how you can become a professional intraday trader.

Best Way to Learn Intraday Trading

You need a trading and Demat account and if you already invest in the stock market, you may want to open an independent account for intraday trading. Then sign up for the right tools for intraday trading that can also manage your Taxes. Once you have the stipulated account and tools, you can start by focusing on daily charts to identify trends in price movement. You may also require some technical knowledge before investing in shares.

How to select stock for trading?

As a day trading for beginners, investing in stocks that are unstable in nature is favourable. The share price target fluctuates more as compared to the others.

The tips for intraday trading provided by brokers must be used as an insight into improved best intraday trading strategies. As a beginner to Intraday trading, never start immediately, after the market opens. In general, take about 40 minutes to interpret and analyze the market sentiment for that day.

Where to place day trades?

Always trade in Intraday Trading with the right trades. Conduct complete research and technical support. Moreover, having knowledge of the right tools is important to maximize your success goals. It is crucial to choose an account with a low brokerage, given the high frequency of transactions. Above that, trading stock in the live market is highly challenging. However, it should not deter you from exploring stock market trading opportunities for wealth creation. Here are three types of intraday stocks trading tips to choose from:

- Swing Trading: Best swing trading strategies generally focus on smaller growth in intraday trading. Such as commodities trading and currency trading. However, it is a diversity approach for trailers.

- Traditional Investing: Traditional investing is a method to invest money into well-known assets. For instance, bonds, futures, options, cash, mutual funds, real estate, etc.

- Digital Advisors: Also known as Robo-advisors. Digital Advisor automates financial planning. It regulates monitoring investor relations, degree of risk and portfolio management. They also help in improving risk management. Moreover, it is a long-term investing plan and poses slow results for daily use.

- Single Trading: Single trading allows you to trade in multiple segments of the financial market. An online broker helps you to set up a single trading account. Contrary, to facilitate proper planning or trade entries, exit trades, and stop loss.

Check: How Option Trade Works in 2023

What types of stocks to choose from?

Choose a stock that has adequate liquidity for executing traders. This will help you where you need to square-off your position before the market closes. You can also invest in large-cap stocks. This will reduce your chances of trades to impact its price.

Stock market trading for beginners is complex. Above that, trading stock in the live market is highly challenging. However, it should not deter you from exploring stock market trading opportunities for wealth creation. Here are 9 criteria to simplify intraday trading:

1. Trading Volume: Trading volume is a crucial criterion when intraday trading. The volume of trade is the measure of shares that are being traded in financial assets. These assets are calculated during a period of time. By simply looking at the price movements in company reports you are not able to locate stocks that are high in demand. Contrary, share volume helps you to identify the stocks being purchased during high volumes.

2. Resistance Level: Resistance level is the price level at which the price rise of securities is halted by the growing number of factors. These factors could be an overwhelming level of securities supply. As a professional day trader, you may identify securities with broken resistance levels, besides, moving northwards.

3. Stock List: The majority of professional traders prefer to trade in a particular asset. The trader always finalizes a stock list after evaluating a chart pattern, price movements, and technical analysis.

4. Stock News: Stock news platforms offer quotes, up to date financial market reviews, portfolio management resources, social interaction, and market data. Consequently, stock news is a unique guide for beginners to anticipate stock volume. Thus, facilitate analysis of time to start day trading.

5. Highest Performer: Typically, you may find a list of top gainers on social media sites like NSE BSE SEBI Mutual Funds news channels. These sites consistently update recent market activity. During the live market, intraday traders can inform productivity.

6. Price Movements: Study of stock price action trading strategies across time horizons. An analysis of the last weekday trade stocks price indicates passive income.

7. Relative Strength Index (RSI): Relative Strength Index RSI is an indicator to measure recent price change. In combination with the Average Directional Index (ADX), these intraday strategies help to find buy and sell opportunities in stock exchanges.

8. Risk Reward Ratio: Smart investors use a risk/reward ratio to compare the expected ROI. Nonetheless, it helps to assess the potential growth to trade relative to its potential loss.

9. Penny Stocks: Penny stocks are the company’s stocks that relatively trade for less than $5 per share. During daily trading, it is important to find the best penny stocks in real time. Subsequently, increases the opportunity to maximize growth. Besides reducing the high-risk of gambling in the stock market.

When to execute trades?

For Intraday Trading, timing plays an important role. In fact, entering the market at the wrong times can lead to a huge loss. Thus, intraday trading time analysis is imperative to achieve success. Many industry experts suggest that it’s better to avoid a position within 1 hour of the trading as the market tends to be volatile.

Check Also: Stock Broker Course

Top 4 Online Courses on Learn Intraday Trading for Beginners

Intraday Trading is a vast aspect of the financial market. It requires a thorough knowledge of financial market assets. This includes the study of technical analysis tools, and fundamental techniques. Here is a list of courses you may want to take a look- if you are planning to learn how to start intraday trading for beginners.

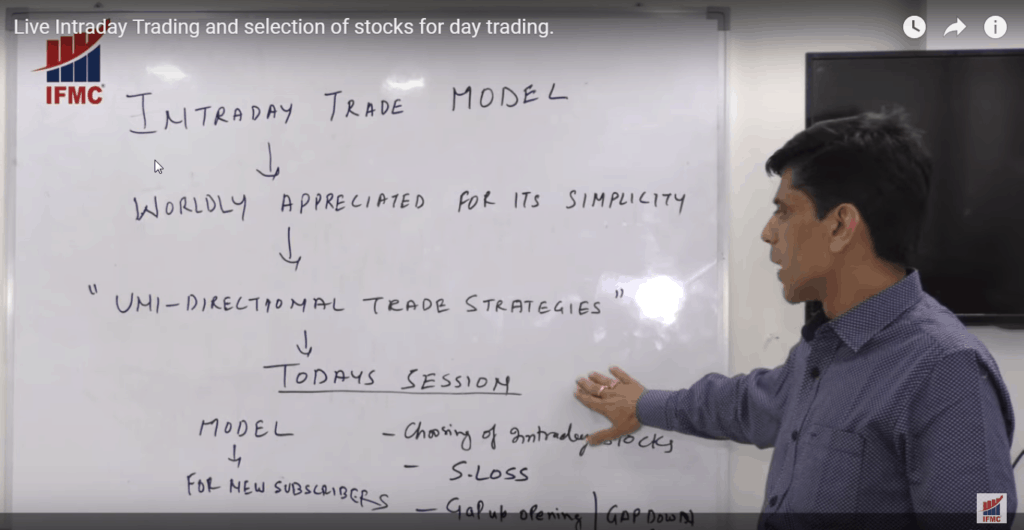

1. Uni-Directional Trade Strategies Course

The best way to learn intraday trading to take an online Uni-Directional trade strategy course. The Uni-Directional trade strategies course is copyright content of IFMC. Learn 9 stock market trade strategies during Intraday Trading, Day Trading, and Positional Trading (long-short term). It is the best course for beginners who want to learn intraday trading. Subsequently, strategies are explained via technical analysis. The strategies are applied in all segments. For instance, Capital Market, Commodity Market, Futures & Options Trading, Equity Derivative, and Currency Market. However, UDTS encompasses conventional technical indicators and combines them in a way to receive the most powerful robust trading strategies. Thus, enroll in the UDTS best intraday trading course for beginners. UDTS is copyright content of IFMC Institute. The course is developed by Senior Research Analyst Mr. Manish Taneja

2. Stock Market Course For Traders

The Stock market course for traders by IFMC Institute is a beginner programme. In this course learn the basics of intraday trading. The course is taught by NSE certified instructors. It is simple and easy to understand the course and make a career in stock market. It covers complete knowledge of theory and practical training on live trading.

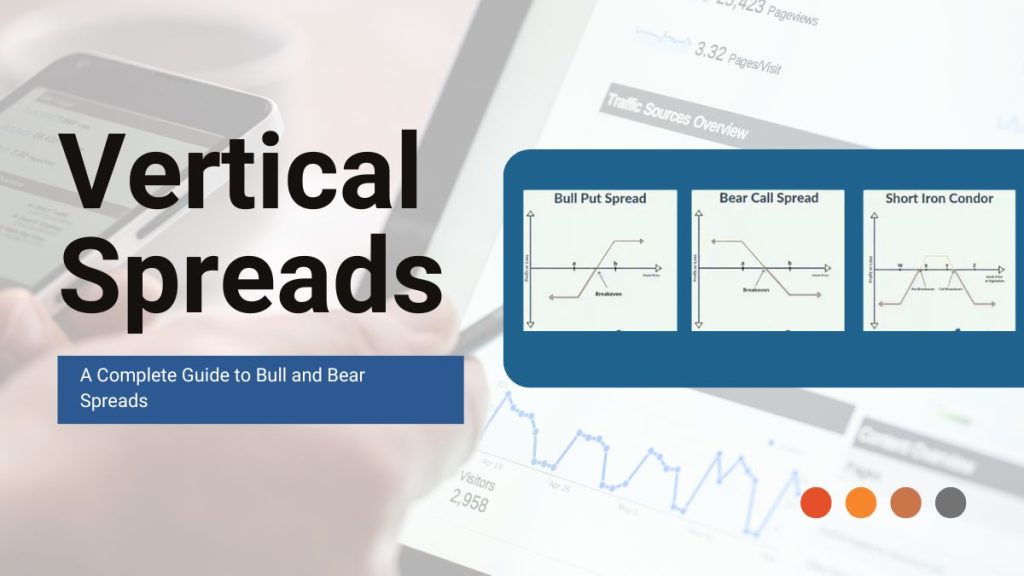

3. Technical Analysis Course

Technical analysis course is the best online course for learning technical analysis techniques. It is a suitable course to learn technical analysis for intraday trading. Technical analysis is an important approach to predict market future value. It is an advance course for traders. As it covers important concepts of technical analysis of stocks. For example, chart patterns, price action, short sell, to intraday trading time analysis.

4. Quick Trader Course For Intraday & Positional Trading

Quick Trader Course is 14 hours of online trading courses. It is the ultimate course for an intraday trader. The course is designed for those planning to begin a career in Intraday Trading at NSE National Stock Exchange or BSE Bombay Stock Exchange.

This course covers an introduction to the basics of four markets that is Capital Market, Derivative Market, Commodity Market, Currency Market along with complete Uni-Directional trade strategies (UDTS) programmes. You get pre-recorded videos in a simple language which makes learning easy.

Intraday trading may be intimidating for beginners. It offers high returns but also comes with risk. Indeed, trading without knowledge is just like gambling. Thus, it is wise to gain knowledge before you get started. You can use the resources above to learn about intraday trading at home. All you need is the willingness to learn and practice a lot.

FAQ

What is intraday trading?

Intraday trading is buying and selling stocks within the same day. Traders are looking to make money from small movements throughout the day. This requires quick decision making and knowledge of market trends.

Key points of intraday trading:

- Short term: Positions are opened and closed within hours.

- High volume: Traders do multiple trades a day to make more money.

- Leverage: Many traders use borrowed money to make more returns.

Stats show that 10% of retail investors do intraday trading, it’s popular. Successful intraday traders use technical analysis, charts and indicators to predict price movements.

How does intraday trading work?

Intraday trading is buying and selling stocks within the same day. Traders make money from small price changes. They don’t hold positions overnight to minimize market risk.

Key points of intraday trading are high liquidity and quick execution. Traders use technical analysis to make decisions. This means studying price charts and patterns to predict future movements.

Stats show 90% of intraday traders lose money. Successful traders spend hours analyzing market trends and news. They use stop-loss to manage risk.

Traders also use real time data to make informed decisions. For example they track stock performance every minute during market hours. This is a fast paced environment and requires quick decision making and discipline.

How to learn intraday trading?

Learning intraday trading involves a few steps. Start with understanding the basics of the stock market. Get familiar with terms like “bull market” and “bear market”.

Next practice with a demo account. Many platforms offer virtual trading where you can test strategies without real money. This will help you to build confidence.

Study technical analysis. It involves studying price charts and patterns. Resources like books and online courses can help.

Stay updated with market news. Economic reports and company earnings can impact stock prices big time.

Join trading communities. Engaging with experienced traders can give you support and tips.

How to start intraday trading?

Intraday trading is buying and selling stocks within the same day. To start intraday trading follow these steps:

- Choose a Broker: Select a broker that has low fees and a user-friendly platform. Look for brokers with good customer service and educational resources.

- Set Up a Trading Account: Fill up the registration form, provide identification, and fund your account.

- Understand Market Trends: Study stock market trends and patterns. Use resources like financial news websites and stock analysis tools.

- Practice with Paper Trading: Use a virtual trading account to practice without risking real money. This will help you to build confidence and refine your strategies.

- Develop a Trading Plan: Create a plan that outlines your goals, risk tolerance, and exit strategies.

- Start Small: Start with small amount to minimize risk while you gain experience.

How to trade?

Intraday trading is buying and selling stocks within the same day. This is a strategy that aims to make quick profit from small price movements.

Key points:

- Time Sensitive: Traders need to make decisions fast. Prices can change in seconds.

- Leverage: Many intraday traders use borrowed funds to increase returns. But this also increases risk.

Statistics show that 90% of intraday traders lose money. Knowing market trends and having a good strategy is key to success.

Is intraday trading for beginners?

Intraday trading can be for beginners but it requires in-depth knowledge and practice. New traders should start with a demo account to understand market dynamics before investing real money.

What are the common mistakes in intraday trading?

Common mistakes are overtrading, having no clear strategy, ignoring risk management, and emotional decision-making. Knowing these mistakes can help you avoid loss.

How important is technical analysis in intraday trading?

Technical analysis is important in intraday trading as it helps you to identify price trends and patterns. Understanding charts and indicators will help you to make better decisions during trades.