Intraday trading guide for dummies who want to learn money-making techniques in intraday trading, day trading, and positional trading.

What is Intraday Trading?

Intraday trading deals with buying and selling of securities within the same trading day. The trades are not kept on hold overnight rather they are squared off by the end of the day price moves. Intraday trading is also known as day traying. Here, traders get involved in buy or sell of stocks with an intention to make profits and not with the intent to invest.

It also refrains stock traders from the losses caused by overnight events that cover after the market is closed. With the right intraday trading strategies, you can make immediate money with market volatility. Many people consider gambling as a value investment. However, one can make huge money in the stock markets by following rules-based to survive.

Intraday Share & Stock Trading How to Invest in the Stock?

You need a demat account and if you already invest in the stock market, you may want to open an independent bank account. Then sign up for the right tools for intraday trading that can also manage your Taxes. Once you have the stipulated trading demat account and tools, you can starts trading by focusing on the daily chart pattern to identify higher prices. You may also require some technical knowledge before investing in shares.

How to Select Stocks for Intraday Trading?

Beginner traders investing in stocks that are unstable in nature is favourable. The share prices fluctuate more as compare to the others indeed if executed properly, you can generate profits. The tips provided by online broker, stock brokers to Learn Intraday Trading can be used as an insight into improved best intraday trading strategies. As a beginner trader to Intraday trading, never start investing immediately, after the market opens. In general, take about 40 minutes to interpret and analyze the market sentiment for that day.

How Intraday Trading Different from Regular Trading?

The only difference between the intraday trading and regular trading is the way it lies in the process of stock delivery. During Intraday Trading, you retain your position on the same day as a result of selling orders offsets your buy order. This results in no transfer of shares ownership. Over the span of time, a regular trade gets settle.

Consequently, you get delivery of the shares you own and the shares you sold out get move out from your demat account.

When To Entry and Exits in intraday Trading?

Intraday trading strategy includes entry and exit signal. It is not possible to buy low and sell high during live market. Practically, this only exists in papers.

Where to place Intraday Traders?

Always trade in the Intraday Trading with core trades is a one who offers complete research and technical support. Having the right tools are important to maximize your profits. It is crucial to choose a trading account with a low brokerage account, given the high frequency of transactions.

What types of Papular stocks to choose from in Intraday Trading?

Choose a popular stock that has adequate liquidity for executing trades where you need to square-off your position before the market closes. You can invest in large-cap stocks. This will reduce your chances of trades to impact its higher price.

When to Execute Intraday Trades?

For Intraday Trading, timing plays an important role. Entering the market at the wrong times can lead to a potential loss. Many industry experts suggest that it’s better to avoid position within 1 hour of the trading as the market tends to be volatile. Thus, rule-based investing is essential for smart investors.

The best way to learn intraday trading to take online Uni-Directional trading Strategies course.

Day Trading for Beginners

Day trading is like operating any other business. It requires good commitment, determination, and effort. Many people make a mistake by learning intraday trading in the wrong way. There are numerous strategies out there. While most of them are scams. Fortunately, there are few popular stock market courses for traders educating beginners on day trading. This page will advise you fundamental of day trading for beginners. We’ll also discuss valuable tips and core strategies to earn profits in 2019.

What is Day Trading?

Day trading is defined as an act of buying and selling securities within a single trade. Day trading is not for everyone! It involves significant risk. Moreover, it requires a conventional understanding of how a market works and several profiting trading plan. As a stock trader, your aim is to take from the market whatever is possible on the same day. Some of the common types of day traded financial instruments are stocks, futures trading, options trading, and currencies.

According to Economic Times, “Day trader refers to the market operator who indulges in day trading. A day trader buys and subsequently sells financial instruments like stocks, currencies or futures and options within the same trading day, which means all the positions that he creates are closed on the same trading day.”

Today, day trading is dynamic. There are several terms to define core trading strategies including personalities and techniques. For instance trend traders, momentum traders, swing traders etc. Although in each case the objective is the same to earn profits. However, the technique employed and the trading time frame is different in each case.

Who is a Day Trader?

A day trader is someone who adheres to a day trading style. In other words, an individual who buy or sell financial instruments within the same day or even multiple times within a day. To take benefit of niche market price movements.

Additionally, intraday-trading is not a part of day trading. It takes dedication, time, and focus. When seeking benefit from price movements over long-term it’s the opposite of investing. Comparatively, day trading involves making a fast decision while executing a large number of trades for relative small profits.

A person cannot be successful in day trading because of a lack of discipline or fear of potential loss. It takes time to develop a knowledge center. Here are some profitable strategies for day trading for beginners.

Trader vs Investment Banker

Traders and Investment Banker in the financial sector have distinct roles. Day trading strategies are not applied in an investment bank. An investment banker is involved in the debt capital market and equity. Indeed it helps corporate executives raise funds, value assets, and sustain in financial business growth.

Day Trading Techniques 99% Winning Probability & Profits

Day traders use several combinations of strategies in an attempt to make profits. It is imperative for day traders to use flexible day trading techniques in 2019 to match current market conditions. Some financial plan requires shorting of stocks instead of buying them. Note: these strategies are also applicable while trading in the Indian Stock Market for Lok Sabha elections 2019. A trader borrows stock and sell in the hope the price will fall, and then again buy shares at a lower price. Let’s look at more trading plans :

- Trend Following: The strategy is applicable during all trading time-frames, assuming that securities which are steadily rising will continue to rise and vice verse with falling. A day trader buys a security which is rising or short sells a failing one in assumption to trend will grow.

- Contrarian Investing: It is a type of stock market investments strategy that is affected by buying and selling in contrary to the prevailing sentiment of the time. A trader buys an instrument which has been falling in an assumption that trend will change.

- Range Trading: Trading in a range is a form of trading financial plan in which a day traders buy a stock at or near low and sells at the higher prices.

- Spread Trading: Spread trading or scalping is a technique where small gaps developed by the bid-ask spread are exploited by the speculator. A day trader involves taking quick profits while minimizing risk. It is one of the most popular types of day trading strategy. It involves selling the stock immediately when a trade becomes profitable.

Day Trading Strategies for 2023

Day trading involves a market that is fixed closes. Although, a day trader can trade any social security. Ultimately, choosing the right market to trade is the key to earn profits including how much you can invest and ready to take a risk.

The stock market is a popular choice for beginner day traders. Because there are several types of shares to trade. While, in the equity market, it is a company practice to close positions on the same day to avoid gapping risk. When overnight influence the market price on the previous day.

However, as a day trader, you can trade in the market for 24 hours such as forex market, currency market and futures trading.

Deciding When to Day Trade

A day trader does not require to trade all day, but consistency is key to success. Alternatively, you can trade every day during the same hours. Preferably the time when the market is volatile and liquidly. This is the most important step for determining day trading position size in stocks.

For the stock and futures trading, the best stock market trading hours are earlier in the day or just before close. It is important to research the opening and closing times as the market hours can vary. Also, consider keeping eye on information releases, events, earning, and other cause to price fluctuations on the market you are trading.

Managing the Day Trading Risk

Many traders manage their trading accounts as they are running a business. Indeed, protecting the capital in their bank account is above all. Thus, risk management is a critical step to prepare before trading. Which is done by:

- Set limits

- Add measures in place to prevent uncertainties

- Use risk management tools like traders toolbox

Day Trading Tips For Beginners

Day trading strategies are essential for beginners. Especially, when you’re looking to capitalize on small and frequent price movements. Before you get bogged down in the complication of highly technical indicators, focus on day trading fundamental. Majority of day traders get overwhelmed to facilitate core strategies to succeed. Let’s look at some basic day trading strategies like Warren Buffett:

- Financial management: Financial management means planning, organizing, and monitoring of monetary activities. Before you start trading, decide how much money you are willing to put on risk. Pro tip: never use your credit card to fund your trading.

- Education: Understanding stock market intricacies isn’t enough. Indeed, you need to stay informed with an existing market overview. This, constant monitoring of market news and events that impact trades are important. For instance, economic policy, foreign trades etc.

- Start investing small: Everyone has a big whilst. Stick to a maximum of 3 shares during day trading. Try to maintain profits with few than to be average. It’s good to make no money than making a potential loss!

- Time management: Stock market is volatile with each day and it’s uneasy for experienced day traders to read chart patterns. Hold back for the first 15 minutes so that you still got some stock market trading hours ahead of you.

- Consistency: It’s important to hold things together. You cannot let emotions come in your way. Similarly, your strategy should always remain in terms of numbers and not emotions. In fact, always make a logical trading plan!

Day Trading Course for Beginners

Like starting a career there are many things you need to learn while day trading. Learn day trading strategies with popular courses from IFMC Institutes knowledge center. The day trading courses are for traders who want to make money out of day trading stocks.

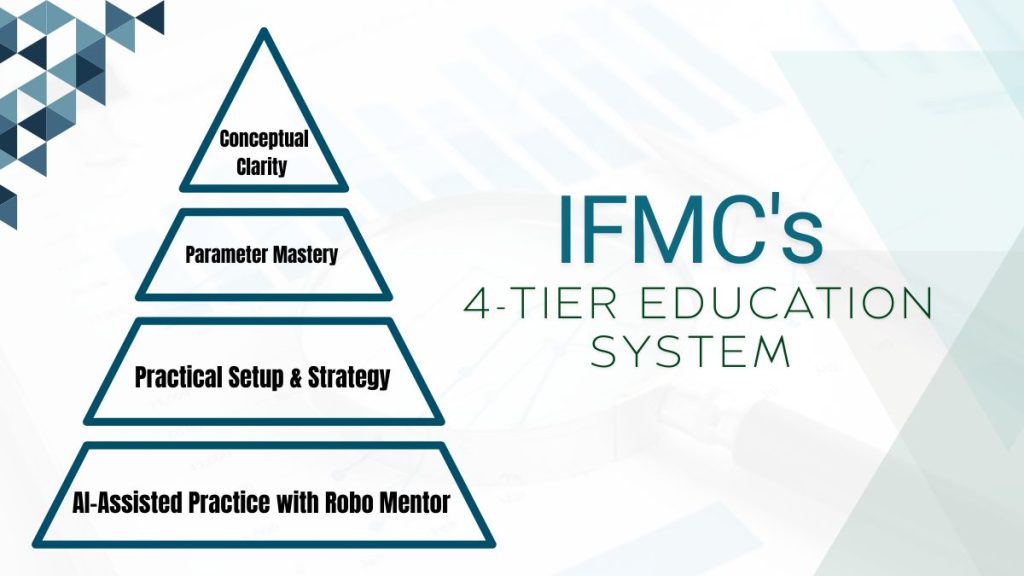

- Uni-Directional Trading Strategies: UDTS course contains market behaviours, basics of technical tools, analytics to find the trend and lastly applicability of technical tools in the live market with examples. It is an award-winning course for Excellence in Financial Market Education. Moreover, trading strategies are popular in more 110 countries worldwide.

- Quick Trader Course: Quick Trade online programme is the basic programme of IFMC targets study of Stock Market for beginners. The students will learn the basics of the stock of all four market that is Capital Market, Derivative Market, Commodity Market, Currency Market along with complete Uni-directional trade strategies (UDTS) programme. You get pre-recorded videos in a simple language which makes learning easy.

- Result Analysis Trade Model: Result Analysis Trade Model is yet another innovative model of IFMC, which has been made and launched by the Research Team of IFMC. After studying this model, you can analyze the company results and do trades in Intraday and long Positions.

Day trading takes time, skill, and discipline. Besides, difficult to master. Many of those who try day trading fail. But strategies and tips discussed above can help you create a profitable strategy. With some knowledge, practice, and consistent performance evaluation can greatly improve your chances to beat the market.

How to Become Successful Day Trader

Select More Than 2 Liquid Shares

Intraday Trading comprises of squaring open market positions before termination of a trading session. Thus, always select 2 to 3 large capital shares that are highly liquid in nature. Investing in a medium-size or small position size can result in the investor holding the shares because of the poor trading amount. Day Trading for beginners can be very risky.

Evaluating day trading Entry Price

Before placing the buy order in a day trading, you must measure profits targets at an entry point price. The intraday trading for beginners course from IFMC online trading academy will boost confidence in investors to make a wise decision as it’s common psychology of a person to change after buying the shares. As a result, you can sell the share even if its price experiences any nominal increase. This can impact to lose an opportunity for higher gains due to the price increase.

Lower Impact through Stop Loss in a day trading

Stop Loss or Stop Order is an automated order to buy or sell the shares when the price reaches a particular level. For investors to learn intraday trading, this is beneficial to limit their potential losses due to the price fall of a stock. The best intraday trading strategies make sure that your emotions are reduced in a way so that you can make an impactful decision.

Neglecting to be an Investor in a day trading

Intraday trading and market investing for beginners both require purchasing of the stocks. However, the trading strategies for both is different on the basis of fundamental and technical analysis. It is common for day traders to delivery when the profit targets are not met. Then they have to wait for the time when the prices are recovered. Learn more: stock market trading classes for beginners

Considering an Alternate Wishlist for intraday share trading

It is always advisable to consider researching on up to 10 shares before making an investment decision. Understand completely about all shares corporate events, real estate, stock splits, mergers, bonus dates, dividend payment, technical levels, etc. You can also use the internet to make supportive decisions.

Best Intraday Trading Strategy Never Move Against Market

Predicting market movements is not a cup of tea as even experienced professionals make mistakes at the majority of times. There are many technical factors that affect the bull market those are indicative in nature and do not possess any guarantees. It is important to exit positional from the market to avoid huge losses when it is moving against your expectations.

Share market returns can be a huge success, while you can start with smaller earning gains by adhering to these best intraday trading strategies for beginners. IFMC best online course for share trading enables you to effectively trade stocks. Thus, get decent returns in one day.

If you have any other tips for day trading for beginners, share with us in the comment section.

The two words that explain positional trading are ‘wait and watch’. This is self-explanatory as a positional trader just have to wait to watch the movement of their trades patiently. That’s all about positional trading? No, like any other stock market, positional trading has its own challenges. It is not as risky as margin trading or intraday trading.

Positional Trading Strategies

What is Positional Trading?

Positional trading is a short term strategy where traders enter the market and hold on to a position until they believe it has reached a situation of a trend reversal. While a trend reversal is a point with the stock price falls. The frame of time for a positional trade indefinite. Unlike Intraday trading or BTST, the position trader can hold the stocks for a few minutes to a few years.

However, it cannot be referred to as a long-term stock market investments as the trader never determine the time frame before market investing. The time periods for waiting can be sometimes long. It is an attempt to take most of the stock upward trend. Henceforth, it is also called ‘Trend trading’.

The trend trading is based on simple assumptions of the current trend that move for a long time in the future.

Types of Positional Trades

Positional trading is not as complex as another trading whereas it’s just a simple process of wait-and-sell. The positional trade emphases on stock movements at a considerable rate in order to gain position. Subsequently, it becomes critical to determine the stock trends and ascertain the entry points and exit points.

Finding a Positional Trading Trend

It is an approach where stock traders perform technical analysis for a potential stock – including determining trends and chart patterns. During this stage, the stock is at the breakpoint and has not started its upward trend. This, a trader predict when the stock trend will begin to enter the market at the right time.

Join the Positional Trading Trend

In this type of positional trading, a trader does not consider to predict the start of the trend. Rather, they just invest in a stock with an upward trend to enter. It may sound a bit easy for many while it requires good knowledge and skills to find the right trending stock to enter the market.

Profiting from Position Trading

Positional trading is not suitable for individual investors as it requires in-depth knowledge to study trends. If you think, you’ve mastered the subject, then you should obviously not ignore positional trading, as you make huge profits.

The whole concept of positional trading is to keep the level as low as possible. Just like other forms of market investing, the risk level results in the level of profits you can make. The stock market professionals can make large profits as they deal with an enormous amount of investment. The majority of the strategies used in position trading do guarantee a specific amount of profits. However, keeping the level of risk is much more important than making profits. As you trade stocks with a huge sum of capital, making a little bit of return is also very significant.

Positional Trading Discussion

To conclude the above discussion, positional trading is the easiest form of trading. While many professional traders find it challenging. Few things to keep in mind is to find the right stock picks, identify trends through analysis, determine the entry point and exit point, and last is to keep a regular track on stock price movements.

Learn Intraday Trading on the Basis of Uni-Directional Trade Strategies (UDTS)

Intraday Trading on the basis of UDTS (Unidirectional Trade Strategies) is a simple technique to make trade stocks accurate. UDTS investing for beginners is so popular worldwide and has all the people across all the segment of Investor and Traders. UDTS investing for beginners is for the common man who wants to make a bright future and understand the behavior of stocks. UDTS is a base of share trading in the stock market.

It is just like a base of pizza on which you can put more and more toppings to make it better and better. You can trade with maximum probability of profits with “UNI-DIRECTIONAL TRADE STRATEGIES”.

Why are Unidirectional Trade Strategies being so popular among traders and investors? Let’s see why and how to buy this globally appreciated online broker course? A must watch video for every beginner and professional trader.

Stocks Trading Accurately means “UDTS” from IFMC Knowledge Center

UDTS is known for online stock market trading for beginners course it’s for its simplicity and applicability and accuracy. It is copyright content of IFMC knowledge center. UDTS is a bunch of strategies of Intraday and positional trade. UDTS is specially designed for individual investors / traders and for all those who are a part of the stock market or Financial Industry. UDTS investing for beginners is designed for beginners and professional those want to learn how to trade profitably and accurately in the stock market.

Uni-Directional Trade Strategies for Beginners & Traders

Technical Analysis Course for Beginners & Traders Trading strategies – This is applicability based video taught to trade more accurately and restrict your losses. This course contains market behaviours, basics of technical tools analytics to find the trend and lastly applicability of technical tools in the live market with examples. A technical analyst can learn an expert approach to a systematic approach to financial forecasting takes into account statistics.

Live Intraday Trading on the Basis of UDTS

Live Intraday trading on the basis of most popular Uni-Directional trade strategies to show how this strategy wonderfully works. Also shown how to stock picks for intraday trading and how to use the stop-loss.

The model has 9 wonderful trading strategies on short positional, positional and long positions trades. Model is universally accepted and appreciated.

TRADER SERIES 1 – Stock Market Trading Videos

Trader Series 1 by IFMC – A Stock Market Institute in Delhi NCR

TRADER SERIES 2

Trader Series 2 by IFMC – A Stock Market Institute in Delhi NCR

TRADER SERIES 3

This trader Series 3 by IFMC online trading academy – A Stock Market Institute in Delhi NCR

TRADER SERIES 4

Trader Series 4 by IFMC – A Stock Market Institute in Delhi NCR.

This traders who want to increase their probability to win in the stock market must watch this video.

TRADER SERIES 5 | PART A

This trader series 5 | PART A – Live Intraday trading on the basis of most popular UDTS (Uni-Directional trade strategies) to show how this strategy wonderfully works. Also shown how to choose stocks for intraday trading and how to allocate money on intraday trades.

TRADER SERIES 5 | PART B

This trader series 5 | PART B | COVERS SELECTION OF INTRADAY STOCKS – Live Intraday trading on the basis of most popular UDTS (Uni-Directional trade strategies) to show how this strategy wonderfully works. Also shown how to choose stocks for intraday trading and how to allocate money on intraday trades.

TRADER SERIES 5 | PART – C

COVERS TAKING OF TRADES IN LIVE MARKET WITH STOP-LOSS AND PROFIT TARGET – Live Intraday trading on the basis of most popular UDTS (Uni-Directional trade strategies) to show how this strategy wonderfully works. Also shown how to choose stocks for intraday trading and how to allocate money on intraday trades.

TRADER SERIES 5 | PART – D

SHOWS THE ACCURACY OF UDTS IN LIVE MARKET – Live Intraday trading on the basis of most popular UDTS (Uni-Directional trade strategies) to show how this strategy wonderfully works. Also shown how to choose stocks for intraday trading and how to allocate money on intraday trades.

“Trade accurately and confidently and increase your probability of profits with UDTS a copy write the content of IFMC.”

To know more ifmcinstitute.com/online-stock-market-courses/unidirectional-trade-strategies

Types of Trading – Day Trading, Positional Trading, Swing Trading & Scalping

Active trading or types of trading is a process of buying and selling of securities for a quick profit in short-time. It seeks to profit from price movements in the liquid market, thus, requires greater time commitment than passive trading. Here is a list of four popular short-term active trading strategies.

Day Trading

Day trading is the most popular style of active stock market trading. As the name suggests, day trading is a method of buying and selling of securities on the same day. Indeed, positions are closed within the same day, thereby, no positions are held overnight.

There are different terms used to define day trading strategies including techniques and personalities. For example, swing traders, momentum traders, instance trend traders etc. Although, in every case, the goal is the same to make money.

Positional Trading

Positional trading is considered as short-term trading where traders enter the market and hold onto the position until they believe it has reached to a situation when the stock price falls. On the contrary, some consider positional trading to be a buy and hold strategy. It used long-term charts in combination with several techniques to determine the current market trend. This type of trade may last for several days or weeks, depending on the trend.

Positional traders look for successive higher and lower highs to measure social security trends. By considering the trends, the positional trader aims to benefit from both up and downside of market movements. They look to measure the market direction, they do not care about for the price level. Generally, a trader enters the market when the market establish itself and exit when the market tends to break. This means that during the time when the market is high volatility, positional trading is more challenging and its positions typically reduce.

Swing Trading

Swing trading isn’t for everyone but can be an effective way to invest. When the market trend breaks, a swing trader enters the game. At the end of the trend, there is generally price volatility as a new trend tries to enter the market. A Swing Trader then buy or sell securities as that price volatility sets in. Comparatively, swing trader holds onto the stocks for a shorter time than positional traders. Besides, swing traders create stocks trading strategies based on technical analysis & fundamental analysis.

These trading strategies are designed to determine when to enter and exit from the market. While a swing-trading algorithm does not have to be the same and predict peak price movement.

Scalping

Scalping is a trading strategy that is employed by an active trader. The trader aims to make many profits on small price changes. It includes exploiting of various price gaps which are caused by bid-ask spreads and order flows. The strategy works through buying at the bid price and selling at the asking price to receive the difference between the two price points. A scalper attempt to hold on to their position for short-term, thereby, decreases the risk involved.

Trading Strategies and Risks

Active traders can employ one or more profitable trading strategies. However before deciding onto which trading strategy to choose, considering the risk associated with them is important to explore.

Online Broker Course for Stock Trading

We all understand that a share is a segment of company ownership. If a company issue 50 shares and you own one of them, you’re a part of 1% stake in a company. The stock market is the best place to invest your money. The million dollar question is how to invest in the stock market and make profits? Keep reading this article to learn stock trading for beginners, what the stock market is, how to invest, and how to buy or sell shares in India. In this article we will answer these questions, importantly, we’ll discuss into the depth of each.

Why Learn Stocks Trading?

Before you decide to invest in the share market, you need to understand the stock basics. You can join the share trading course offered by the Institute of Financial Market Courses (IFMC). During the course module, you will grasp a complete understanding of the market along with the personal finance best tips to make success in the stock market.

In India, primarily there are two stock market exchanges: Bombay Stock Exchange (BSE) and National Stock Exchange (NSE). We have learned throughout life about the importance of saving and investment for a safe and secure future. Although in order to minimize the impact of inflation and other related risks of investing in the share market, investing in the conventional financial instrument are not adequate. The share market offers a lucrative opportunity for those who are looking for something extra; by buying and selling of securities.

Stock market basics for beginners

What is the stock market?

A stock market is a place where the shares of the public listed companies are traded. In other words, it is a process of buying and selling of stocks less than one single platform. This may include securities listed in the primary market as well shares listed in on privately traded sector. A stock market can also be referred to as an equity market or share market. Currently, every stocks trade is conducting through a computer terminal at the office of a sub broker or via the internet.

What are stocks?

A stock is a popular financial instrument in the world. It is ownership in the company representing to claim company earning or asset. In fact, stock or share of flexibility, choice, as well as different levels of risk.

Difference between the primary market and secondary market

Initial Public Offering (IPO). While on the other hand, when an investor is able to buy or sell the company’s shares after they are listed in IPO, it is called a secondary market.By now you have learned how to invest in stocks. Let’s discuss other important concepts to stock trading.

How to invest in stock market?

- Find your investment IQ: Firstly, you need to understand the concept of stock trading and how it works. Besides, if you’re immediate, brushing up your skills won’t harm. Learn stock trading from a professional stock market institute.

- Take a beginner investor course: Secondly, take a professional course from a reputed institute. IFMC Institute is a top online trading academy for excellence in financial market education. A course features tons of features, tools, techniques, and stock marketing strategies.

- Pick up a solid stock: Learning stock trading includes a live trading session. By studying solid stock research, you can learn how to pick the best stock.

- Open a brokerage account: Find a good online broker to open an account. Become acquainted with the layout to benefit from free tools.

- Learn how to invest in stocks: Once you learn what is stock? the next step is to learn how to invest in stocks. Books offer a wealth of knowledge and are an inexpensive mode of financial education. You can also subscribe to IFMC Institue YouTube Channel to learn stock trading for free. The stock market article and blogs are also a great way to gain knowledge.

- Find your trading style: Once you learn the basics, it’s time to develop own trading style. Stock trading courses focus on building an investing plan. Wherefore, successful traders commit to using their investment plan for all trades.

By now you have learned how to invest in stocks. Let’s discuss other important concepts to stock trading.

How the price of a share determined in the market?

Generally, in a market scenario, the price of a share goes up when a company is earning high profits. During such an event, investor shows their interest to purchase the shares resulting in high demand so does the price. The price of a share is directly related to its demand. Hence, the demand is the prime factor for determining the price of a share. Similarly, there are several factors which affect the price of a share. You can learn from the experts at a professional stock trading for beginners at IFMC.

What are share indices?

You may have heard hundreds of times people saying that the market is going up and market in falling. If you read the stock table, you’ll realize that not all stocks rise or fall. There can be few stocks those moved in a different direction. When the stocks are listed for exchange, few stocks are grouped to form an index on a different basis. The stock indices are required for sorting out shares, representation, comparison, passive investment, and reflection of investor sentiment.

Stock Market & Share Market Trading Strategies

IFMC makes the process to learn stock trading for beginners start with UDTS stock trading simplified with unique Unidirectional Trade Strategy Course. The course is available on both online and offline platform. Indeed, the course is designed for investors, traders, and fresher’s those aspire to learn the best intraday trading strategies and other share trading strategies.

Must Watch: Learn Share Trading

Stock Market Trading for Beginners YouTube Knowledge Center

Stock Trading for Beginners Online

Stock trading is a tough career but with IFMC online course stock trading for beginners, it will help anyone wants to learn Stock Trading. Whether you are new to the field or experienced veteran. Joining an online course that offers professional training is an efficient way to get a financial education. The online stock trading course is the best beginners guide and forex traders. Besides, for trained dealers who are looking to extend their capabilities. So, jump start your trading career with this inclusive beginner course on building a solid investing foundation.

Which is the best training online for stock market trading for beginners course in India? IFMC offers an online stock trading course for beginners. The course aims at a specific niche audience in a unique teaching style. Whether you’re new to stock trading or you’ve been trading for years. There are a few things that will help your career quite as much as holding comprehensive learning on extensive trading strategies. Fortunately, you do not need to go back to college to start a new degree. You can learn how to trade in stocks online effectively and build career in stock marketing.

Online Stock Trading Training For Beginners

Not all courses are equally curated. Unfortunately, you need to be extra careful, unlike university course. Contrary, before signing up for any stock market online course make sure that the class is legitimate. Some of the stock market trading jobs prospects after this course are sub broker, securities sales agent, financial agents, money managers, portfolio manager, investment banker, personal financial analyst, and financial analyst. Look at these, four characteristics before you sign-up for an online course.

Professional Trainers

Attending online courses is pivotal to success than just receiving information from books and articles. IFMC best stock trading classes are taught by faculty with 30+ years experience. Those are renowned industry trading experts. However, training for expert removes hurdle, makes the process efficient and likely to result in quicker progress. Whether the course is for beginners or professionals, only consider from an expert within the industry. Thus, this will make sure that you acquire accurate and latest information.

Live Practical Training

During an online course, you may run into the concept you don’t understand. IFMC online stock market training course offers students support tools. Also, practical stock training and live training sessions are comprised.

Covers complex topics

IFMC stock trading courses deal with specifications. We attempt to appeal to students to the basic and advanced traders concepts. While the advanced traders comprise of complex topics. You can carefully read the course description before sign-up.

Affordable

Cost is an important factor when deciding which course to choose from. But it isn’t the only factor. Our every online course claims to teach you stock trading. It is one of the most affordable online course for students. We understand the importance of money for beginners in the industry and deliver the same.

What’s more? Here is a list of pros:

- A great approach to training

- Helpful content

- Up-to-date curriculum

- Wonderful balance between technical and fundamental analysis

- A wide variety of training approaches

- Best learning curve

- Flexible learning times

Final Words

Making money through stock trading isn’t a cup of tea. However, with the great mentorship and support from a skilled professional, you can gradually begin to make business sense. Institute for Financial Market Courses (IFMC) is the best stock market institute in India. The institute offers courses like Technical Analysis, Fundamental Analysis, a Diploma in Financial Market, Equity Research, Commodity Market Course, Capital Market Course, and Currency Market.

To conclude, IFMC is an excellent online training platform to learn stock trading for beginners. Nonetheless, we provide specialized training by skilled trainers. We also offer an attractive blend of features in comparison to other training courses.

Stock Trading Strategies

This stock trading strategy beginners guide will help investors to uncover opportunities in the markets. By applying professional trading strategies, an average investor can benefit to earn profits.

Why do you need a trading strategy?

The stock market is constantly changing its behaviour so your strategies should evolve constantly. Your strategies should define the use of the best market trend and situation. You need to utilize a proper trading strategy to earn profits. Now, let’s dive into the winning trading strategies for all time:

What is the Best Stock Trading Strategy?

It seems like a simple question, but the answer can get more complicated as you begin. Earning profit from stock trading is a prime goal of every trader or investor. If you are a passionate trader you should have prepared several trading strategies for different market situations. Here is a list of 6 Best Stock Trading Strategies:

Growth Investing Capital

Growth Investing is a style of investment gaining attention to many investors. It focuses on the growth of an investors capital. Thereby, applied when companies continue to grow their profits. Companies reinvest profits back instead of using cash flow to improve operations as well as to entice investors with a dividend. Typically, in exchange for forming dividend, investors expect that share price and profits will increase. Therefore, growth investing is most successful when investors determine that profits can be easily supported by driving efficient sales.

Income Investing Assets

Income investing is an act of picking up a good stock by putting together a collection of an asset. For instance, stock, mutual fund, real estate, and bond that generate the maximum annual income at the lowest risk possible. However, most of the income is paid to investors for everyday use. Especially, during an uncertain economic market situation.

Short Selling

Short selling is also referred to as shorting or going short. It means the sale of securities that a seller has borrowed to make a short sale. This type of trading strategy produces profits in a declining stock market. The method includes borrowing equity shares from a stock brokers, selling them, and then selling then stock to return. Although the approach can be challenging for a successful trader.

Value Investing

Value investing is an investing strategy where stocks are identified which appear to trade for less than their intrinsic value. Unlike, other investment strategies, value investing is simple. Investors buy shares and hold until the market price rise. Thus, this strategy is successful when the stock market is volatility is low.

Momentum Investing

Momentum investing is an approach to buy securities that offer high returns over the past 2 to 12 months, and selling that has poor returns over the same time. It involves long-going stocks and future ETF showing upward trending prices. Additionally, it includes disproportionately trading in stocks with high bid asl spreads, thus, important to evaluate momentum profitability when taking transactional cost into account.

Quality Investing

Quality investing is an investment strategy based on clearly defined fundamental criteria that help to determine companies with outstanding quality characteristics. In simple words, it is a quantitative investment approach that focuses on buying a high-quality company. The quality assessment is made both soft and hard criteria. Thus, a quality investing strategy is the best in the class approach.

Share Trading

Share Trading, Stock Trading, Nifty, Sensex fascinate people over all walks of life because of its high Return on Investment (ROI). People come to share market inadequately prepared and view it as a quick profit-making mechanism.

People entering the stock market must have a clear understanding of the subject and a clear view of the market. They must understand the do’s and don’ts of the market. Trading without adequate knowledge and/or on the advice of friends, peers or RM’s do not get profit or more appropriately the returns.

The market never gives anyone a loss but it is a person who bears the loss because of inadequate knowledge, lack of view and without proper homework or analysis. IFMC – Institute of Financial market courses a Delhi based financial education Institute specializing in Financial and stock market studies has made;

- Simplistic approach

- Designed a system

- Series of strategies

IFMC Institute of Financial Market Courses has been awarded “ Excellence in Financial Market Courses” at Delhi City Icon Awards 2018 this August. The awards were organized by Radio City in Delhi. The ceremony was held at Pride Plaza Aerocity, Delhi.

IFMC’s Career-oriented programmes are very popular but more than that its programmes of investors and trader series are even more popular. UDTS – Uni-Directional Trade Strategies is one of its kind programme specially designed for Beginners in the stock market and for all those who have been trading in the stock market for long but are not able to trade accurately in the market.

learn Share Market Trading Strategy

“Unidirectional Trade Strategies” popularly known as UDTS is an application-based product of IFMC. UDTS is a copy write the content of IFMC. The course studies core trading strategies for Intraday and Positional trade.

UDTS is a ready reckoner for all those who are the beginner. Additionally, who are trading in share market for a long time in Intraday or Positional segment. Thereby want to increase their probability of successful trades.

The trading strategy is so popular worldwide and has grabbed eyeballs of Investor, trader and all those working in the industry. Since its launch in April 2018.

UDTS is known for its simplicity, applicability, and accuracy. Everyone can see charts, everyone can study Technical Analysis but the most important thing is to apply these in the market. So that the probability to get the trade executed accurately increase.

IFMC knowledge center has made understanding of share market trading easy and simple.

USP of UDTS is –

- Simplicity

- Usability

- Applicability

Unidirectional Trade Strategies – UDTS

“Har Stock Trader ki Pehli pasand”

IFMC is a pioneer in making people understand “How to trade” in the Indian stock market and not just imparting bookish knowledge. UDTS has is acceptability across all age groups, all categories of Investors and Traders. Students, housewives, professionals retirement planning are also among the satisfied category.

UDTS gives Freedom from cumbersome analysis to the stock trader. UDTS is making STOCK TRADING SIMPLIFIED

IFMC’s Senior Analyst Mr. Manish Taneja is having experience of more than 20 years. He and his team are committed to bringing courses and products which are very simple and easy to understand and apply in the market.

UDTS is a brainchild of Mr. Manish Taneja who has put in a lot of efforts and experience in making simplified strategies in Intraday and Positional trades. The strategies have revolutionized trading and have made trading extremely simple for Beginners, Investors, and Traders around the globe.

These are various Technical Analysis tools available. Some of the popular theories or tools are developed by various technical analysts around the world like Aroon developed by Tushar Chady, Bollinger band by John Bollinger, MACD by Gerald apple and many more.

Now here comes a simple tool developed by IFMC under the mentorship of its Senior Research Analyst Mr. Manish Taneja, UDTS – Unidirectional Trade Strategies a copy write the content of IFMC.

IFMC Institute has its own Youtube Channel a stock market for beginners knowledge center which has informative series of videos and subscriber base of 51,000 in just 6 month and increasing day by day.

UDTS is a must for every trader trading in the Indian stock market.

Share Market for Beginners

Learn share trading, how it works, and how to develop your own share trading strategy. Read the tutorial and follow a step-by-step checklist to get started today.

Share market may seem like chaos activity. However, it an efficient process that utilizes the buying and selling of securities. Before you make an investment through shares, you have to understand them. Learn share trading basics including what is share market, how to trade, and more.

Share Trading Technique to Build Wealth

Share trading is a technique to build wealth. The process of trading shares has become a common word. You may have heard the jargon enough times. But What is share trading?

When you trade shares, you are buying or selling a company segment in the financial market. This process is also referred to as a stock exchange. Each share has a value. While a share value determines the company existing performance. However, future performance can impact share price as well.

What is Share Market?

Share market is a place where traders can buy or sell ownership of investible asset allocation. For instance, like bonds, mutual funds, real estate and derivative contracts. These shares trade on a stock exchange or over the counter. Shares are also known as stocks and equities. They represent fractional ownership in a company. However, share market efficiently functioning is critical for economic developing. Because gives companies the potential to access capital from the public in short-time.

Share Market Terminology for Beginners

- Blue Chip: A blue chip company is with a national reputation for quality, reliability, and ability to generate profits. For instance, Commonwealth Investment Bank, Telstra, BHP Billiton, SEBI, Reliance, and more.

- IPO: An Initial Public Operating (IPO) is a very first stock sale used by a company to the public.

- Income shares: Income shares is a class of capital stock offered by a company that pays a dividend to shareholders.

- Growth-Share: Companies that re-invest profits for long-term growth:

- Rights Issues: A right issue is a dividend of the company right to buy additional securities at a discounted rate.

- Market Capitalisation: It is a term used to define the market value of a public traded company outstanding shares.

- Bull Market: A bull market is a sustained period when the stock market value is growing.

- Bear Market: A bear market is a market condition when the securities price is failing.

- Day Trading: A day trading is an act of buying and selling of securities within the same times. Indeed, is a stock trading strategies where shares are purchased for short-term capital gains.

- Sectors: A sector is a similar group of companies. For instance, the agriculture sector is comprised of pesticides and agro shares.

- Capital Growth: Capital growth is a situation when an asset allocation increases in value over time.

- Settlement Date: A date when a person has to make payment for trade purchased.

- Balance Sheet: A balance sheet is a company’s financial report that helps day traders to understand company current understanding.

- Growth Stocks: A growth stocks is a share in a company which is anticipated to increase significantly above the average market to generate sustainable positive cash flow.

Best Stock Market Courses

- JOB ORIENTED

- INVESTOR & TRADER

- ADVANCED LEVEL

How to Learn Stock Trading?

Stock trading is an excellent way to grow wealth. But how to invest in stocks? Follow these basics steps below to learn how to trade shares:

- Get Educated: The initial step toward becoming a competent share trader is financial education. IFMC Institute is the best institute to share training courses in India. The institute offers courses – both free and premium. These courses are very affordable. Your training shall encompass NSE Technical Analysis as well as Fundamental Analysis. Additionally, you will require to build experience in share trading techniques, portfolio management (portfolio manager), and money management.

- Choose an Investing Style: There are several approaches to share trading. Comprehensive training in share trading will help you build your own investing style. Everyone like free online courses

- for share trading. IFMC Institute offers one-to-one free lessons.

- Fastrack your Learning: Here comes alternative to free courses including in-person classroom classes and online courses. For premium online trading, training can join IFMC stock market course for traders. Going for online premium courses will help to learn faster and can get hands-on higher-quality content. Thus, you can save time and money. Similarly, a share market trading course for traders offers facility of a mentor. A mentor will guide you with practice on live trading sessions.

- Choose a Share Trading Method: The two basic share trading methods are Electronic Traders and Exchange Floor Traders. Electronic trading is an online mode of trading. Whereas floor trading is an offline mode of trading.

- Avoid Trading Scams: Avoid to be a part of an investment scam. It’s easier than you think for scammers to take your hard-earn money. In fact, investment scams come in a different form, besides, the internet has made it easier. Thus, formal financial education to analyze investment scams can help you avoid uncertainties.

How to Make Profits from Share Trading?

As discussed, share trading is a way to create wealth. Here are three way to make money through share trading:

- Capital growth: Capital growth is a common way to make money from share trading. This is simply when you sell shares from more than you paid.

- Dividends: Another way to earn profits is through Dividends. This is when the company directors choose to pay company profits to shareholders. Although, Dividend payments are the basis of the number of shares you own. This type of shares is referred to as income shares. Moreover, not all companies pay divides, thereby, the directors can reinvest profits rather than paying a dividend. These types of shares are called growth shares.

- Tax benefits: A share can be stamped officially. You can also use franking credits in order to reduce the tax on other income.

What are the Benefits of Share Trading?

- Share trading allows investors to make money in both short term and long term. Additionally, it offers a provision to save tax.

- Share is a liquid investment, thus, an easy way to get your money in two days after you make a trade.

- Shares are a proven way to invest for long term capital growth.

- Receive a capital gain tax discount after holding on to the shares for more than 12 months.

- As a shareholder, get the right to vote in company decision and attend annual general meetings.

Independent Trading Decision & Investment

If you’re planning to manage your own investment and make an independent trading decision, you need to learn the following concepts:

- How to set stock prices?

- Ways to understand stock quotes?

- How to determine a stock value?

- How to protect stock profits?

- Things to avoid investment scams?

Share Trading Course for Beginners

Share trading course for beginners gives you the flexibility to learn share trading. It is a must-do a program for traders. Become a stock trading expert with IFMC Institute. IFMC is an award-winning institute for Stock market education. During the course, you get the knowledge of Intraday Trade and Options Trade. Students looking for an NSE, NISM, NCFM certification, mutual fund distributor can also apply. After completing this course students can pursue a career in stock market India. Some of the stock market trading jobs prospects after this course are stock brokers, securities sales agent, financial agents, money managers, portfolio manager, investment banker, personal financial analyst, and financial analyst.

Stock Market Course For Beginner

Stock market course for beginners covers basics of Stock Markets i.e what is Share Market and what are the four major legs or markets of Share Market viz Capital Market, Derivative Market, Commodity Market, Currency Market and how these markets are interlinked.

This course is designed for new entrants in this market and is designed in the most simplistic manner to make the understanding clear.