Certificate course in stock market with the Growth of Indian economy, the stock market and financial sector is growing in the country and as per NSE, there will be one crore plus jobs in the market in next decade. However, Working in Financial Market, Share Market, Stock Market require altogether different skills. The candidate should not only be prompt and sharp with good analytical skills but also should have a good set of knowledge.

Gone are the days when people in the Stock Market, Share Market were given on job training and simple graduates or undergraduates were also taken in the Industry. This was primarily considered to be a male-dominated area but now females are also making their presence felt in the market.

Not only graduates people who have done MBA, CA, CS, ICWA and other professional courses are also pursuing these exams as possession of these certificates not only provide rewarding career but also give a huge platform of knowledge One can work with Mutual Funds, Stockbroker, Financial Market and Securities Market.

What is the difference between NISM and NCFM Examination

There is a significant difference between the National Institute of Securities Markets (NISM) and the National Centre for Financial Market Regulation (NCFM) Examination. NISM certification is required for those who wish to work in the securities market in India, whereas NCFM certification is only required for certain specific job roles. employed in the financial sector.

NISM offers a variety of training programs and courses, which are designed to increase participants’ knowledge and understanding of the securities market. The NCFM, on the other hand, administers tests that assess an individual’s competency in specific Financial Market modules.

Interestingly, although NISM is necessary for employment in India’s securities market, it is not regulated by any governmental body. The Securities and Exchange Board of India (SEBI) has recognized NISM as a provider of educational qualifications for those working in the securities market. NCFM, on the other hand, is regulated by SEBI.

NCFM certification is valid for a period of one year, after which it must be renewed. NISM certification, on the other hand, is valid for the duration of an individual’s employment.

In conclusion, NISM certification is required for those wishing to work in India’s securities market, while NCFM certification is only necessary for specific job roles in the financial sector. NCFM certification must be renewed annually, whereas NISM certification is valid for the duration of an individual’s employment.

NISM is engaged in developing a nse certification examination for professionally employed in various segments of the Indian Security Market. These exams are developed by NISM as a mandate under SEBI (Securities exchnage board of India).

NCFM exams mostly are related to activities of the securities market in India. They are pursued to test one’s knowledge in that particular field.

Why these certificates are for Limited Validity

These certificates have limited validity of 3-5 years depending on the series and certification. The passing marks are also different for each subject. For example, NCFM Capital Market Dealer Module has passing marks 50% whereas NISM Series – VIII Equity Derivative Examination has 60% passing marks and certificate validity is for 3 years. The NISM Courses ensures constant up-gradation of the professional working in this field.

What is CPE Programme

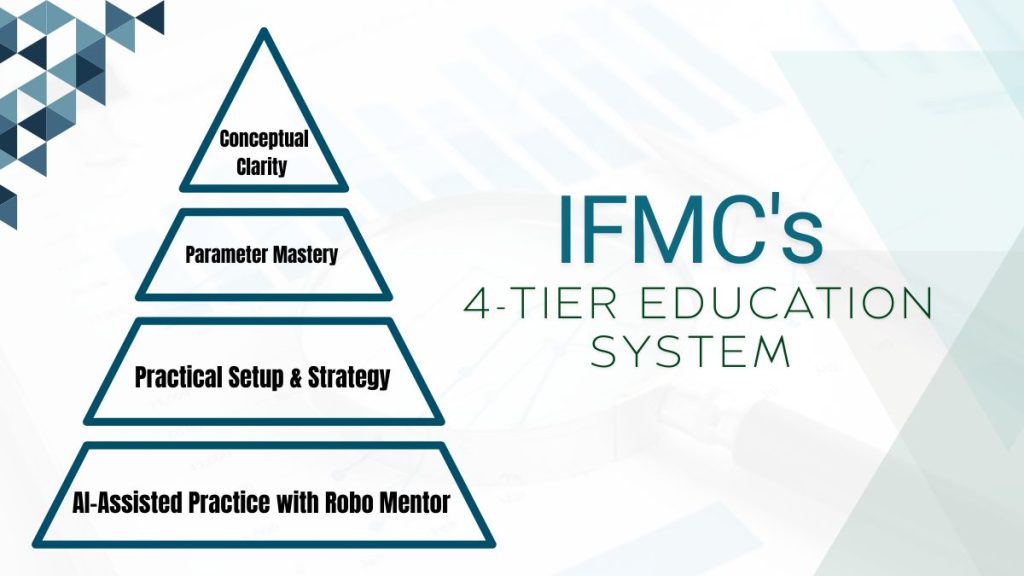

NISM Performs 2 function delegated to it under SEBI regulation.

- Offering mandatory certification examination for associated persons in Securities Market Intermediary.

- Offering continuing professional education CPE programme for the associated person in the market.

Before expiry of the certificate, the certificate can be revalidated by passing the relevant exam or by successfully completing a programme for relevant one day “ Continuing Professional Education ″.

CPE may be specified by NISM.