A career in the stock market offers lucrative opportunities to both investors and traders. This article explores how to make a career in the stock market the right way.

Today, nearly every job description dealing with the market is very competitive to comprehend and sustain. The Indian stock market is a marketplace that many people don’t plan to take up as a career choice because of risk factors. But to a surprise for many people, the stock market excites them to join as a career option, as they can make huge revenues along with consistent growth.

The Indian stock market is full of surprises, but if you choose to move in the right direction, then you can surely make a successful career choice. But before getting started, there are a few things you should know.

Let’s discover more about growing opportunities for a career in the stock market.

Introduction to Career in Stock Market

Starting a career in the stock market can overwhelm some. If you are among those people who understand the depth and details of the Sensex and Nifty, then you can certainly take up a career in the stock market. Further, a stock market is an uncertain career because of the difficulties with the market movements. If you follow the right way to establish your career in the stock market, it can be the best decision of your life. However, if you need a stable career, then you must join share trading stocks and investment courses. After studying these courses you will easily get intraday trading jobs in Mumbai, jobs in stock broking firm in Delhi, or find work from home stock market jobs, or share tips and become a stock market tips provider, trading tips provider, or share market tips provider.

Career In Stock Market

Today, investing courses are becoming a mainstream program for new investors and retail traders. The LinkedIn ‘Jobs on the Rise’ report published a list of ‘15 fastest-growing career opportunities in India in 2021’. The article suggests that, among all other professionals, financial jobs are one of the most demanding sectors for job professionals in the capital markets. Keeping in mind the demand for a job required to pursue a career in the equities market, it’s time to upgrade your skills.

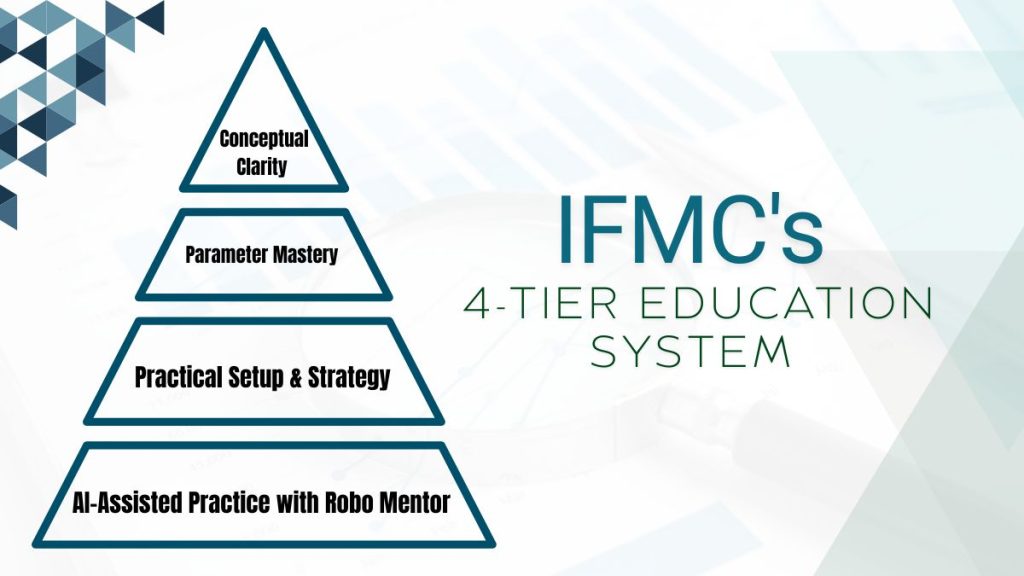

To help new stock market investors and traders learn the skills required to become successful in the financial sector, IFMC Institute launched a variety of courses. Each course is carefully designed for Stock Market Traders to master investing and trading techniques so that you don’t need to depend on investment advisors. Students can choose from the stock market beginner, intermediate, to advanced level courses.

The stock market basics course walks you into the world of the share market. This is the program designed for knowledge seekers looking to start a career in the Indian Stock Market. In this course, you’ll learn microeconomics and macroeconomics of stocks, IPOs, Demat, Derivatives, and trading basics.

Further, an advanced stock market course for professionals offers detailed knowledge of the equity markets for wealth creation. This covers stock market theoretical and practical know-how on determining the risk of a stock investment. This program also covers the study of technical analysis and fundamental analysis of stocks. Both of these topics are essential for job seekers as financial service professionals.

Technical analysis course teaches the right trading style to analyze correct entry and exit timing and prices through the study of charts. While the fundamental analysis course teaches trade proper entry and exit time. With the right trading style, you learn to find and analyze companies profitable for investment.

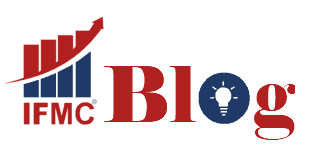

After completing the course in the stock market, students can work in the financial market for various profiles. Some popular career opportunities available in this domain are:

- Equity dealer

- Financial manager/relationship manager

- Wealth manager

- Financial planner

- Arbitrage dealer

- Business development manager

- Investment advisor

- Mutual fund advisor

- Broker / sub-broker

- Hedge funder

- And many more

How to Make A Career in Stock Market in India?

The stock market has intrigued the general population of India for a long. This explains the low participation level when compared to other developed countries. However, the capital market enigma is slowly fading away. Besides, people are ready to invest and take a risk in the market. With the growth in participation, the non-bank financial sector is to leap even faster than it is already growing. Therefore, there is a huge demand for working professionals in this sector. Here is a list of popular stock market courses.

Stock Market Course For Investors and Traders

– Stock Market Course For Beginners

– Technical Analysis Course

– Options Strategies Course

– Quick Trader Course

– Stock Market Course For Stock Traders

– Stock Market Course For Professionals

– Advance Course For Financial Advisory

– Fundamental Analysis Course

Stock Market Advance Level Course

– Investment Analyst & Portfolio Management

– Research Analyst SEBI, NISM XV Series

– Investment Advisory XA Series

Stock Market Job-Oriented Course

– Equity Dealer Certification

– Certificate Course in Stock Market

– Diploma In Financial & Stock Markets

– Advanced Diploma in Financial Markets

– Diploma Investment Advisory

– Diploma In Research Analyst

Career Opportunities in India After Stock Market Course

Let’s define a stock market career. Stock market traders a specialization in the fields of securities commodities and financial, trading stocks, technical analysis, financial advisor, options trading, future and options trading, and technical analyst. They work for Investment Companies, Financial Institutions, Retirement Funds, Brokerage Funds, and other Financial Organizations.

Check What is fundamental analysis

Some of the common duties performed by stock market traders include communication with stockbrokers, buying and selling stock orders, day trading, intraday trading, online stock trading, and completion of the required paperwork.

Who is a stockbroker? A stockbroker is involved in the process of buying and selling stocks, mainly for their clients. They constantly communicate with their clients, regularly update themselves about market fluctuations, and advise clients when to buy or sell stocks, sell securities, and at what rates. Correspondingly, a stockbroker makes sure that their stock trading company also generates high revenues during the long run.

With the steadily growing market in India, it is obvious that those who deal in the market shares can make a rewarding career. Absolutely, a career in share market-related jobs might be a very good option besides vast growth opportunities.

| Eligibility | Courses | A career in the Stock Market |

| A career in the Stock Market after 12 | Advance Diploma in Financial Market Diploma in Financial & Stock Market Certificate Course in Stock Market Quick Trader Stock Market Course for Traders Stock Market Course for Beginners Equity Dealer Course |

Financial/broking industry Stock Broker A career in Indian Broking House Mutual Fund Advisor Fund Managers, Distributors, Equity Dealer, Stock Broker |

| A career in Stock Market after Graduation | Advance Diploma in Financial Market Diploma in Financial & Stock Market Quick Trader Course Stock Market Course for Professionals Technical Analysis Course Fundamental Analyst Option Strategies |

Mutual Fund Advisor Fund Managers, Distributors, Equity Dealer, Stock Broker |

| A career in the Stock Market after Bcom | Advance Diploma in Financial Market Diploma in Financial & Stock Market Quick Trader Course Stock Market Course for Professionals Technical Analysis Course Fundamental Analyst Option Strategies |

Mutual Fund Advisor Fund Managers, Distributors, Equity Dealer, Stock Broker |

| A career in the Stock Market after BBA | Advance Diploma in Financial Market Diploma in Financial & Stock Market Quick Trader Course Stock Market Course for Professionals Technical Analysis Course Fundamental Analyst Option Strategies |

Mutual Fund Advisor Fund Managers, Distributors, Equity Dealer, Stock Broker |

| A career in the Stock Market after an MBA | Advance Diploma in Financial Market Diploma in Financial & Stock Market Quick Trader Course Stock Market Course for Professionals Technical Analysis Course Fundamental Analyst Option Strategies |

Mutual Fund Advisor Fund Managers, Distributors, Equity Dealer, Stock Broker |

| A career in the Stock Market after Engineering | Advance Diploma in Financial Market Diploma in Financial & Stock Market Quick Trader Course Stock Market Course for Professionals Technical Analysis Course Fundamental Analyst Option Strategies |

Mutual Fund Advisor Fund Managers, Distributors, Equity Dealer, Stock Broker |

Equity Trader Responsibilities

Equity traders are responsible for buying and selling stocks and other securities on behalf of their clients. They work with a variety of clients, including individual investors, hedge funds, and institutional investors.

Equity traders must have a thorough knowledge of the securities market and the ability to make quick decisions. They must also be able to effectively communicate with their clients and keep them updated on market conditions.

In addition, equity traders must be able to manage risk and maintain a disciplined trading strategy. Equity traders who are successful in their career can earn a significant amount of money by following powerful trading strategies.

However, they also face a high degree of risk. Those who are not successful can quickly lose their job. Equity trading is a high-pressure career that is not for everyone. However, those who can thrive in this environment can be very successful.

Trading company job titles

Job titles at trading companies can be confusing. At first glance, it may seem like there are very few positions available. However, a closer look reveals a wide variety of roles that support the company’s operations. For example, traders buy and sell goods on behalf of the company, while analysts research market trends and identify profit opportunities. Accountants manage the company’s finances, and compliance officers ensure that its activities comply with regulations. In addition, trading companies often employ customer service representatives to interface with clients and shipping managers to coordinate the movement of goods. As such, there are many different job titles at trading companies, each of which plays an important role in keeping the business running smoothly.

Types of Jobs in the Stock Market

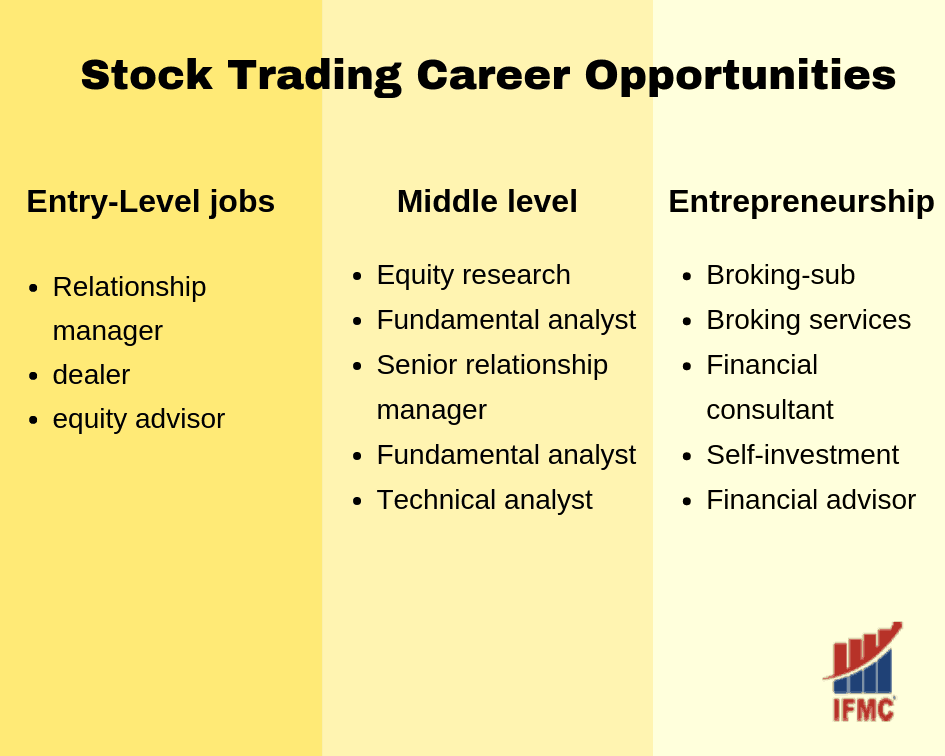

Stock market jobs are classified into entry-level, middle-level, and entrepreneurship.

Career in stock market trading

| Part-Time Career in Stock Market: | Stock Traders (Day Traders) Stock Broker |

| Full-Time Career in Stock Market | Stock market analyst Stock exchange market Trainer Financial analyst / Financial Advisor / Financial Manager Equity analyst Derivatives analyst Hedge fund manager Mutual fund manager Relationship manager Risk analyst Market researcher Investment advisor Technical Analyst Fundamental Analyst |

| Best Career in the Stock Market: | Training Company Broker Sub-broker Technical Analyst Develop a trading platform |

Stock Market Employment Opportunity

- Large Businesses

- Magazines and Newspapers

- Research

- Mutual funds

- Investment consultancies

- Insurance companies

- Broking firms

- Investment banks

- Pension funds

- Other financial institutions

Eligibility Criteria to Get a Job in the Stock Market

Eligibility Criteria for Stock Broking. The minimum education qualification required to become a stockbroker is graduation with 2 years of experience in the stockbroking company career in the stock market after graduation. Whereas a sub-broker needs to pass the 12th standard career in the stock market after 12th to be eligible for a job. However, the minimum age requirement is 21 years.

A career in the finance stock market jobs is not the only option to enter the market. The stock market requires people with the passion, dedication, intelligence, and capabilities of specialists from diverse fields. For instance, economists who understand the ins and outs of stocks, financial planners / Financial Managers for financial goals, who can give you the right advice on stocks. Similarly, you also become a financial analyst, financial manager, financial advisor, or market specialist.

You need to have a background in commerce, economics, and business administration to become a professional stockbroker. However, you can join the best stock market institute in Delhi to learn stock trading.

Jobs After Stock Market Courses

How to become a stockbroker? A career in the share market is indeed the best option. There are various job opportunities in various organizations. Stockbroker simplifies the stock market terms. This also includes good trading stocks practices to the clients. Further, they offer financial counseling and devising financial portfolios. Here are a few stock market career options:

- Entry level Career in the Stock Market jobs for freshers: Equity Advisor, Relationship Manager, Dealer, Sales Agent, etc.

- Middle level Career in the Stock Market: Technical Analyst, Fundamental analyst, Stock analyst, Relationship Manager, Equity Research

- Entrepreneurship: Advisory service, Broking-sub Broking services, Self-investment, Financial Advisor, Personal Financial Advisors, Financial Manager, Financial Consultant

Stock Market Jobs Salary

There are many career options in the stock market and employment opportunities for stockbrokers in India at large broking firms, mutual funds, investment banks, investment consultancies, insurance companies, and pension funds. If you have the potential to cope with a strict work schedule and a high volume of competition, you have a bright future in the stock market.

Additionally, the salary of the stockbroker is highly dependent on your qualifications & performance. The starting salary of a trading stockbroker in India is Rs 20,000 to 25,000 per month (between Rs. 2 to 3 Lakh per annum). Overall, having an MBA or any other advanced level degree will take you to a higher slab. However, for experienced stockbrokers, the sky is not the limit.

- Relationship Manager: Rs 1,96,527

- Financial Advisor: Rs 2,18,500

- Stock Broker:Rs 6,00,000

- Financial Analyst / Financial Manager: Rs 4,09,756

- Operations Manager: Rs 4,12,500

- Commodity Trading Advisor Salary: Rs 3,00,000

Career in Stock Market Trading: India Perspective

Stock market career options can be categorized into a part-time, full-time job, and starting a business. Finally, let’s dig deep into career options:

A stock trader must thrive in a stressful work environment. They should be adaptable to changes and focused on the action quickly, besides, learn stock trading if you retain strong communication, analytical, and interpersonal skills to be a successful stock trader. There are 1.3 million jobs in the Indian Stock Market. Remember, the capital or financial market is much more than just picking up stocks and making big money. It’s a multifaceted sector where people are willing to enter to make a gratifying career. Here is an intended list of skills required to become a stockbroker.

- Patience

- Confident

- Logical Thinking

- Good business acumen

- Problem-Solving

- Good Communication skills

- Excellent mathematical skills

- Analytical

- Responsible

How to Become Successful in the Stock Market

Here are seven trading tips to become a successful stock market expert:

- Passionate: Undoubtedly, you need to be passionate about the markets. Without passion and dedication, you’re inevitably going to fizzle out. Because the market can relentlessly require you to upgrade your skills and improve your knowledge.

- High level of integrity: Investing in the stock market requires lots of work and management. A successful financial market-oriented company requires a responsible team for money.

- Define goals: The financial market is not just about picking stocks. Within the stock market, you can choose to work in Assessment Management, Broking & Distribution, and Wealth Management. Furthermore, understanding which field interests you most will help you to make a smarter career choice.

- Deciding what you want: Once you know which part of the capital markets you want to be associated with, it’s important to gain an understanding that how it works and other business work, meanwhile, search for an opportunity in the financial market where you need to go.

- Choose the right mentor: Selecting a stock market course that is best in the industry will allow you to start a career appropriately. It’s a career that requires an accurate prediction. Hence, requires proper guidance to add value in different situations.

- Master in the stock market: As you know where you want to go and which field you want to work in, relevant educational qualifications, bachelors degree in finance, business finance, master’s degree, or college degree for stocks will set you apart from the competition. Thus, it’s essential to choose from which institute of stock market to study for deciding how to proceed in the market.

- Select workplace wisely: Entry levels students in the stock market should search for the right exposure in the market for future growth prospects. In order to increase your career productivity while students can join the best online course for share trading with the freedom of studying from anywhere and anytime.

Institute For Stock Market Training

To summarize, working in the financial market is not a simple job. It requires full knowledge of the market, rules to adhere to, and other policies to sustain in the market. Only the ones with the right attitude can cherish and enjoy the time spent learning about the stock market. Thus, plan what you want to achieve by working in the stock market. Look into how much money you can invest. Also, explore our share market classes online free for more insights on the stock exchange.

Learn stock market trading in India from a reputed institute of career in stock market. However, certain job descriptions/profiles demand a certified employee. Also, few NCFM or NISM certifications are mandatory, like equity dealer certification for the equity dealer profile. Furthermore, if you already have a job, you can begin with part-time investing and trading in the stock market.

Join top schools IFMC Institute best online course for stock market beginners. Discover a financial institution if you want to pursue a full-time job. Else, if you are interested in starting a business, then it requires huge capital and risk-taking capabilities.