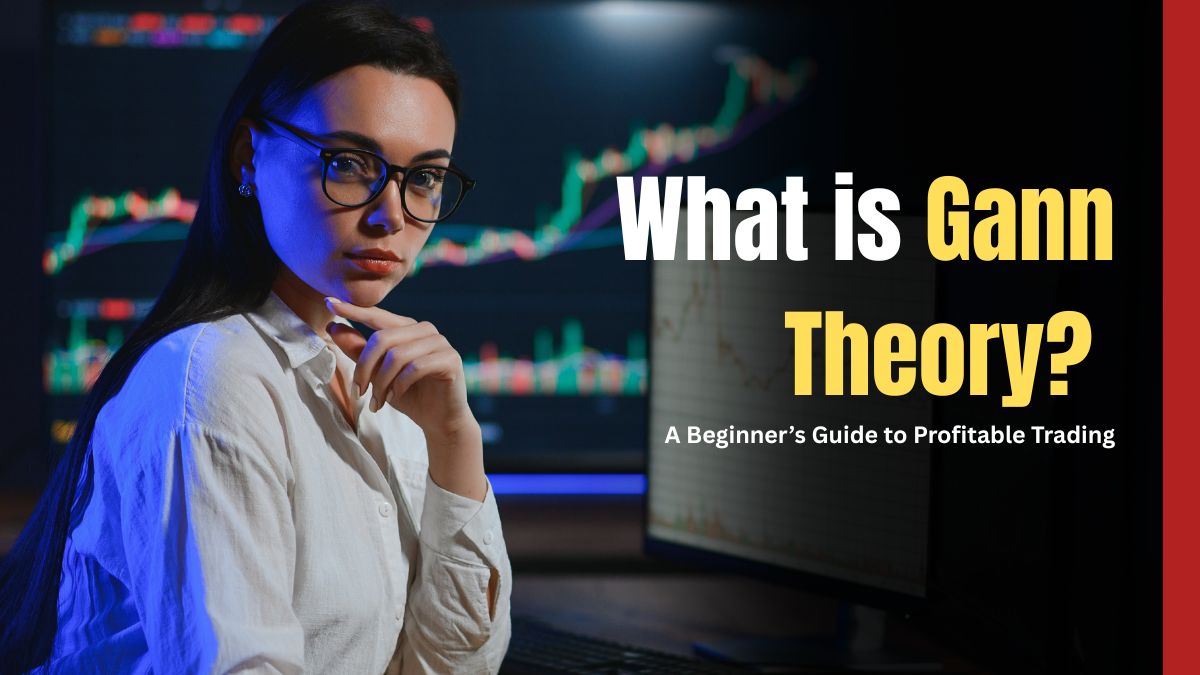

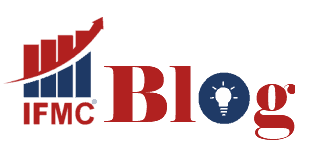

What is Gann Theory? A Beginner’s Guide to Profitable Trading

Stock trading is about timing and precision. Every successful trader looks for methods to

Stock trading is about timing and precision. Every successful trader looks for methods to

IFMC announces new batch from 18 Jan, Noida for Research Analyst SEBI, NISM XV Series. Hurry Up only few seats are left. Book Your seat now.

Alpha tells you how much a stock or portfolio beat or lagged its expected

Beta shows how sensitive a stock is to market moves. A beta of 1

Trading volume is the total number of shares or contracts traded during a period.

IFMC announces a new batch for the Option Strategy Course starting on August 15th. Hurry up, as only a few seats are left. Book your seat now!

Intraday trading and options trading are two of the most exciting segments in the

IFMC announces new batch from 20th August 2025 for Certification Course in Stock Market. Hurry Up only few seats are left. Book Your seat now.

Introduction to Market Volatility Market volatility is a fundamental concept in financial markets, which

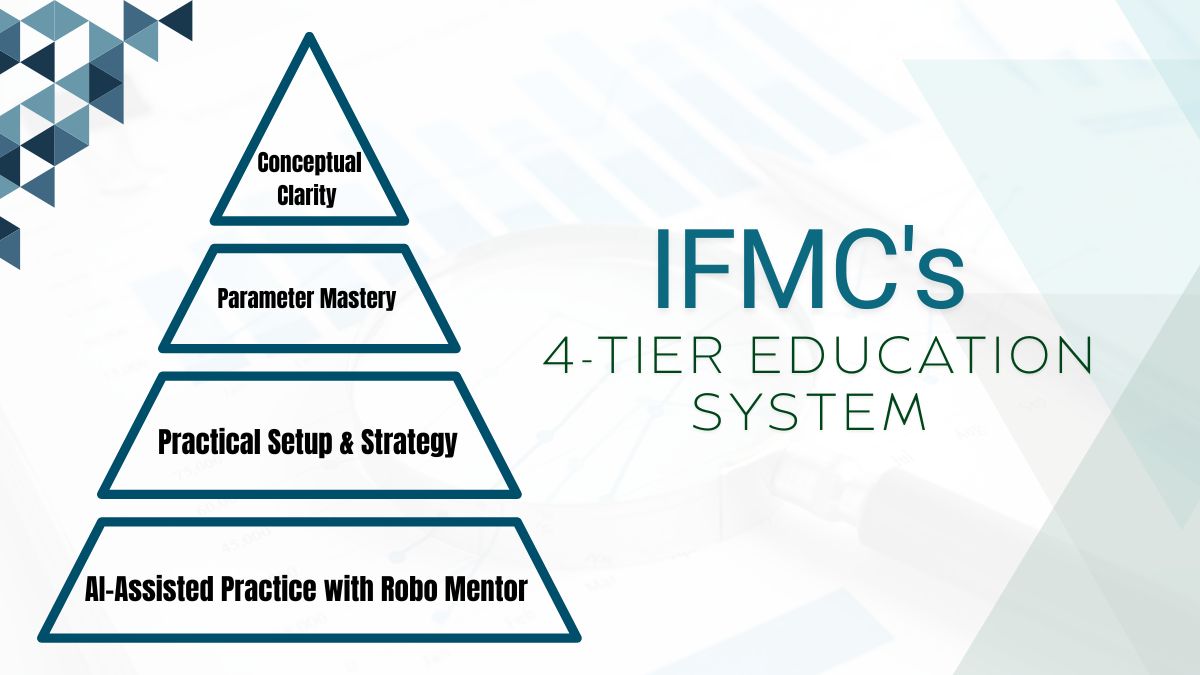

What is IFMC’s 4-Tier Education System? IFMC Institute’s 4-Tier Education System is a comprehensive