When it comes to options trading, success hinges on having a solid option trading strategy. This article simplifies the best options trading strategies. It puts them into a form you can act on right away. It works for various markets to find simple option trading strategies for bullish, bearish, and neutral markets. It will help you refine your option trading strategies and decisions and simplify your path.

Key Takeaways option trading strategy

- Options trading provides a versatile toolkit of strategies. We tailor the strategies to bullish, bearish, and neutral market conditions. They enable traders to capitalize on different market scenarios and manage risk well.

- These strategies include the Bull Call Spread, Bear Put Spread, and Iron Condor. They aim to grow from market movements. They do this by using options to control losses. They do this by simultaneously buying and selling options. The two trade options may have different strike prices and end dates. These strategies can help traders achieve maximum success by leveraging market movements effectively.

- Advanced trading tactics include the Iron Butterfly and Calendar Spread. They are for experienced traders. They exploit specific market traits, like volatility and time decay. However, using them requires a deep understanding of the market and options.

Decoding options trading strategies

Trading options isn’t about luck, it’s more like a strategic battlefield where each move is critical. Options trading is beautiful because it is flexible. It offers many option trading strategies. They can help you grow from different market scenarios. You might expect the market to rise, fall, or stay neutral. But, there’s an option trading strategy for you.

Option trading strategy and the strike price

At the heart of options trading are call options, and put options contracts. A call option contract allows buying an asset at a set price. You can do this within a specific time. The buy is a bet on the asset’s price rising above the strike price. Put option contracts give the right to sell an asset at a fixed price before the end. They aim to grow from a decline in the asset’s price. Understanding the expiration date of these put options contracts, is crucial as it determines the last date on which the holder can exercise the put options contract itself, significantly impacting the outcome of various trading strategies. The stock price directly impacts the success of these options, influencing the risk and execution of strategies like bull call spread, bear put spread, married put, long call, long put, covered call, and short put. These basic strategies, when utilized, can pave the way for consistent gains.

Crafting a bullish bias with options

When optimism sweeps the market, bullish strategies come to the forefront. For those new to the jargon, ‘bullish’ means a positive outlook. It’s about the market or an asset. It’s with an expectation of a rise in its stock price. Investors can use bullish strategies to grow from rising asset or stock prices. They can range from buying a simple call option to using a bull call spread. These strategies also help manage risk and reduce loss potential.

The rate of success of these bullish strategies is directly influenced by market trend and the underlying asset’s price. If the underlying asset’s price increases, the potential gains from these strategies also rises.

But the market can be a fickle friend. Even in bullish conditions, unexpected twists can occur. That’s where the beauty of option trading strategies by Manish Taneja shines. Techniques like the bull call spread let traders limit potential losses. They also cap the net premium spent. This provides a safety net even in volatile markets.

Mastering the bull call spread and the same expiration date

The bull call spread proves to be a reliable ally for traders in rising markets. In essence, it involves two call options with different strike prices but the same expiration date. This creates a spread. The spread can limit upfront costs but may benefit from an upward market shift. The maximum gain achievable with a bull call spread is realized when the underlying asset’s price at the expiration date, of higher strike price of call, is above the strike price of the sold call option.

To do a bull call spread, a trader buys a call option that is in the money and another trader sells a call option that is out of the money, ensuring both options share the same expiration date. The proceeds from the sold call option help offset the cost of buying the in-the-money call. This is a bullish strategy, a strategic play that handles risk well.

Exploring the synthetic call

The Synthetic Call strategy is a safety net in uncertain markets. It is a potent weapon for traders. It’s a mix of owning the stock and buying an at-the-money put. This setup is like owning a long call but with downside protection. It lets traders benefit from price rises or gain an edge during stagnation or decline.

Navigating bearish markets through options

A bearish market calls for a strategic shift and change in your trading approach. Bearish in market language refers to the probability of a decline in the price of an asset. But a falling market need not be a trader’s nightmare. With the right trading strategies, it can be a realm of opportunity.

One such strategy is the covered call strategy, which involves selling a call option while owning the underlying stock, thereby generating income even in bearish markets.

The Bear Put Spread and the Bear Call Spread are two strong strategies. They can help you grow from falling markets. These strategies offer gains. They also limit losses and capitalize on the expected fall of the asset.

Deploying the bear put spread

Among bearish strategies, the Bear Put Spread holds a dominant position. This strategy involves buying a put option. You also sell another put option with a lower or higher strike price. The goal? We want to limit losses and gain from an expected asset decline. We also want a clear gain and a fixed cost.

The bear put spread makes its most benefit when the underlying asset’s price closes below the lower strike price. This happens at the end. This strategy allows for gain if the underlying asset’s price moves down. This means the strategy needs careful planning and execution. But, it can be a powerful tool in a bearish market.

The mechanics of the bear call spread

The Bear Call Spread is yet another strategy that flourishes amid bearish markets. The strategy involves conducting two transactions at the same time. One trade involves selling an In-The-Money call option with a lower strike price. The other involves buying an Out-Of-The-Money call option with a higher strike price. Both options rely on the same underlying asset and share the same end date.

In a Bear Call Spread, the trader gets a net premium paid out from the option sold. Comparing it to the net premium paid out for the same stock option bought. If executed, this could result in growth. The most advantage comes if the asset’s price closes below the lower strike at the end. This lets the trader keep the premium paid the initial credit.

Neutral ground: options strategies for market indecision

Markets aren’t always bullish or bearish, at times, they remain neutral. In times of market stability or uncertainty, neutral options strategies come into play. These neutral options strategies include the Long Straddle and Iron Condor. They let traders grow from small price moves in the underlying asset itself, or even from market indecision.

You might use options strategies: the Short Straddle, the Long Strangle strategy, or the Condor strategy. They offer ways to earn income. They also protect investments when the market is stable or indecisive. These options strategies are useful. This is especially true when the market lacks a clear upward or downward trend.

The long straddle dance

Capitalizing on market volatility, the Long Straddle serves as a neutral strategy. An investor does it by buying both a call option and a put option at the same time. Both are for the same thing at the same strike price, and time. This allows for unlimited gains. The most you can lose is the cost of the call options and put options.

It is effective during volatile markets. The Long Straddle allows for gains from options positions and big price moves in either direction. But, for the strategy to turn a benefit, the stock must move a lot. It must move enough to generate income to cover the cost of both options.

Iron condor: the strategy of precision

Thriving in low-volatility markets, the Iron Condor is yet another notable neutral strategy. This strategy involves selling an at-the-money straddle. It also involves buying protective calls and puts. The term for these is ‘wings’. The goal is to earn a net premium on the position. This happens when at the money options the stock stays within a price range. This reflects low volatility.

Creating an Iron Condor involves a delicate dance. You buy and sell options with different strike prices but the same end date. The strategy requires precision and careful planning. But, it can bring big rewards in a stable market.

Advanced options techniques for experienced traders

For experienced options traders, the option trading options strategy and landscape becomes even more captivating. Advanced option trading strategies exist. They include the Iron Butterfly and Calendar Spread. They offer more advanced tactics for experienced traders. These techniques involve many contracts. They have different strike prices. They allow you to manage risk and gain from many market scenarios.

They are the Bull Ratio Spread, Bull Call Butterfly Spread, Box Spread, and Long Strangle. These complex strategies can be set up with limited downside, limited risk, and maximum advantage potential. But remember, managing risks in these trades means understanding the potential for gain. And for loss. It also means ensuring the use of stop-loss orders to reduce risks.

For a deeper understanding, the Option Chain Course is an invaluable resource for mastering these strategies and navigating the complexities of advanced options trading.

Unveiling the iron butterfly

As intriguing as its name suggests, the Iron Butterfly is a unique strategy. It involves selling an at-the-money straddle while simultaneously buying protective calls and puts. This strategy can earn income. It is more likely to make a small gain when the underlying stock is not volatile.

The most you can gain with an Iron Butterfly is the total premium received from the sold options. The maximum loss, but not the maximum loss not the obligation amount, occurs if the stock moves beyond the highest or lowest strike prices. The strategy can bring big rewards. But, it needs careful planning and precision.

The calendar spread concept

It requires a deep understanding of options trading. The Calendar Spread is an advanced options strategy. This options trading strategy involves buying and selling options. The options have different expirations but the same underlying asset. The goal of options strategy is to benefit from the time decay difference between the two options.

The Calendar Spread can be a powerful tool for experienced traders. It works by using the difference in time decay. Yet, all advanced strategies need deep market understanding. They also need careful execution.

Options trading strategies for intraday success

Intraday trading presents a completely different scenario. Here, we focus on growing from short-term price moves. They happen in a single trading session. This requires constant vigilance and swift decision-making to hedge existing positions and leverage intraday volatility.

It could be the Momentum Strategy. It leverages market trends. Or, it could be Scalping. It focuses on growing from minor price changes. These intraday strategies help traders make the most of each trading session. But, they need a strong grasp of market movements. They also need to use stop-loss orders to reduce risks.

Momentum moves: capitalizing on trends

Riding an out of the money up wave is the essence of the Momentum Strategy in options trading. This strategy focuses on entering positions in assets. The underlying assets have clear price trends, either up or down. The goal is to grow from the continuation of these trends.

News, financial events, or market sentiment drive the market trend here. The Momentum Strategy needs traders to make fast decisions. The market’s momentum is the basis for them. It’s all about seizing the moment and capitalizing on market trends.

The art of scalping with options

Scalping is a strategy designed to capitalize on minor stock prices rise, or stock price falls, and fluctuations. It involves making many trades during the day. Traders often close positions shortly after opening them. The goal? To accumulate growth from these minor price changes.

Yet, scalping is not for the faint-hearted. It requires precise timing due to the risk tolerance the short-lived nature of each trade. Traders must understand market movements. They need to enter and exit positions.

Summary

Options trading is diverse and dynamic. It offers many strategies to navigate markets. The strategies are bullish, bearish, neutral, and advanced. Each offers a unique way to tackle the market and gain from its movements.

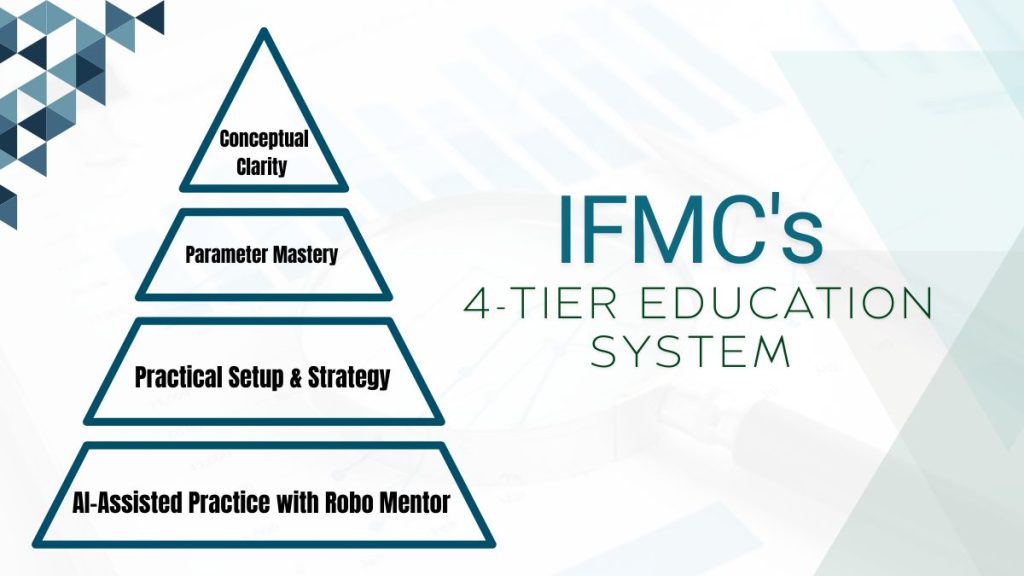

We are finishing our journey through the best options trading strategies here. Success trading options often lies not in understanding these strategies, but in knowing when to use them. Master options trading with the Options Strategy Course with UDTS© Strategy. You can use the market’s power to your advantage, turning market chaos into steady gains.

Frequently Asked Questions

What is 3 30 formula in option trading?

The 3-30 rule in option trading states that a stock’s price tends to change a lot in the first 3 days after a major event. Then, it stabilizes or corrects for about 30 days. This pattern can offer insights for traders.

What is a Bull Call Spread?

A Bull Call Spread is an options trading strategy. It uses two call options with different strike prices. The goal is to limit upfront costs and gains from a rising market. It’s used in rising markets to manage downside risk further. It also lets you capitalize on upward shifts.

How does a Bear Put Spread work?

A Bear Put Spread involves buying a put option at same strike price minus call prices. At the same time, you sell another put option with higher strike call at the same strike prices but a lower strike price. This limits losses and lets you grow from an expected decline in the asset.

What is a Long Straddle strategy?

A Long Straddle strategy involves buying a call and a put option. They are on the same underlying security and the same underlying asset, with the same strike price and end date. It allows for unlimited gains with a limited loss.

What is the Iron Butterfly strategy?

The Iron Butterfly strategy involves selling an at-the-money straddle. You do this while also buying protective calls and puts. It aims to make you out of the money. It is likely to yield a small gain when the underlying stock is not volatile.