IFMC® Institute, India’s Number #1 Stock Market Training Institute

India’s Leading Stock Market Institute - Learn. Trade. Succeed.

IFMC® Institute is trusted by more than 200,000 learners, students, and viewers worldwide. Backed by strong Google reviews and a powerful digital presence, IFMC Institute has earned its reputation as India’s most trusted place to learn stock trading and investing. As the first and only stock market institute in India with copyrighted trading strategies, we simplify the art and science of trading through uniquely designed courses and practical training.

Led by SEBI-registered professionals with over 30 years of stock market experience, IFMC stands for trust, innovation, and excellence in financial education. We are ISO 9001:2015 certified and offer a wide range of NISM and NCFM certification courses, stock market trading programs, and share market courses in both online and classroom formats. Our comprehensive curriculum helps beginners, investors, and professional traders learn the market from the basics to advanced levels.

Recognized by 200,000 plus learners across online platforms, classroom programs, and YouTube, IFMC has become India’s most preferred destination for stock market education. Our structured, easy-to-follow courses are powered by proprietary trading models that make complex topics simple, including Technical Analysis, Options Strategies, and Fundamental Analysis. Learners gain practical know-how and the confidence to trade profitably and build careers in the financial markets.

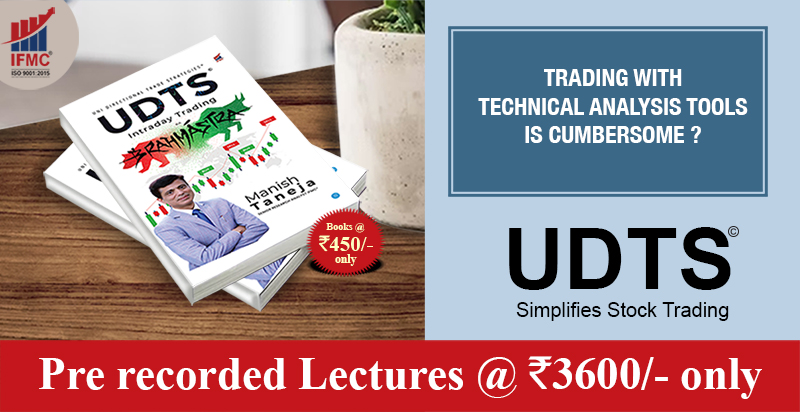

We prepare students for NSE, BSE, NISM, and NCFM certification exams and offer more than 20 advanced courses and tested trading strategies. Our world-class learning tools and the bestselling book “UDTS©, Intraday Trading Brahmastra” have helped thousands of traders master the markets with discipline, simplicity, and confidence. IFMC also holds the YouTube Silver Play Button, with more than 200,000 subscribers and 14 million plus views. It reflects a strong and trusted learning community.

Every course at IFMC is taught by NSE-certified faculty with over 15 years of trading and teaching experience. We focus on hands-on learning, real market exposure, and practical training that sets new benchmarks in financial education. Our innovation-led approach keeps evolving through advanced tools and technologies. The legendary UDTS© Strategy, our most successful and time-tested trading model, now runs as algorithmic software by Algo Screeners It is changing how traders learn, practice, and execute. Another breakthrough, the UDS-VSM tool, delivers data-driven insights that help investors make smarter, safer, and momentum-aligned decisions.

Experience live intraday learning with “Your Winning Formula for Intraday,” powered by UDTS© Robo Trade. It is officially approved, whitelisted, and compliant with Bajaj Broking, Bajaj Finserv Ltd. With the right blend of experience, technology, and innovation, IFMC continues to empower traders and investors to pursue financial freedom through education.

Classroom Training

Your search for the best share market institute ends at IFMC. It is India’s top-rated institute for stock market learners for share market education. IFMC has nearly 22 various courses in various combos to meet the need of stock traders, investors, and job seekers who wish to join the skill-oriented programs along with MBA, BBA, graduation, diploma, or any other professional course like engineering or medical or paramedical. IFMC is the best stock market institute where students from all over India apply and only a few get the chance to come and get trained at the institute.

Learn moreOnline Courses

India’s best online stock market learning platform, designed for Beginners, Students, Housewives, and Working Professionals, offers the flexibility to learn trading and investing from the comfort of home. Whether you're starting fresh or upgrading your skills alongside graduation or work, the platform provides simple, practical, and easy-to-understand courses. It’s the perfect choice for anyone looking to build strong financial knowledge and lasting confidence in the stock market. With expert guidance and real-world strategies, you’ll be ready to take control of your financial future.

Learn more

Why IFMC® Institute is India’s Best Stock Market Institute

IFMC ®- Is Best Stock Market Training Institute in India.You are investing in Knowledge.

IFMC ® is ISO Certified Institute of Stock Market

IFMC ® is Pioneer & has a monopoly on Stock Market Courses & Trading techniques.

IFMC ® is the only Institute having its own copyright Trading Strategies UDTS ©️ & M.A.D.E. ©️

IFMC ® has its own unique teaching Tools to understand the concept of Trading & Investment.

IFMC ®️ has its own book UDTS ©️ Intraday Trading Brahamastra - A comprehensive guide for all beginners, traders & investors.

IFMC ® has a belief of 13 Million plus learners associated with IFMC ®

IFMC ® - Has Best Reviews on YouTube and social media (Reviews in lakhs).

IFMC ® - Emphasis on practicals, tests, viva & Projects.

Why Should You Join IFMC ®

IFMC® ही क्यों?

- IFMC Stock Market Institute Has 100% Placement Record

- Gain 100% Confidence to Trade in Financial Market

- Unmatched Trading Strategies UDTS©

- Practical Training

- Best Stock Market Courses Online

- 20 Plus Stock Market Trading Courses

- Get Mentored by Sr. Research Analyst Mr. Manish Sir

- Short Term Trading Course

- Only Institute with Copyright Strategies

- Beginners to Advanced Courses

- Experienced Faculties

- Learn to Trade with Accuracy

LEARNING TOOLS AND RESOURCES

UDTS© INTRADAY TRADING BRAHMASTRA - BOOK

- The Ultimate Weapon To Become A Professional Trader

MOCK TEST-PRACTICE QUESTIONS PAPPERS FOR NSE, SEBI, NISM, NCFM CERTIFICATION

Entry Exit का खेल

Why is UDTS So Popular Amongst Stock Market Traders?

UDTS Best Intraday Trading Course

IFMC ONLINE & CLASSROOM STOCK MARKET INSTITUTE IS BENEFITING

-

Stock Market Traders Losing Money in Stock Market

-

Anyone who wants to trade in Indian Stock Market for Extra Returns.

-

Housewives and Retired Professionals

who want to Generate

Extra Income.

-

Anyone who wants to be a consultant and sub-broker.

-

Students of CA / CS / ICWA / CFA who want to upgrade their knowledge.

-

After Graduation / Post Graduation / MBA - Skilled Training Course for Quick job / Career Oriented Courses on Stock Market.

IFMC CHANNEL